WTI Crude Futures - Looks Like a Minor Consolidation

rhboskres

Publish date: Tue, 16 Apr 2019, 09:09 AM

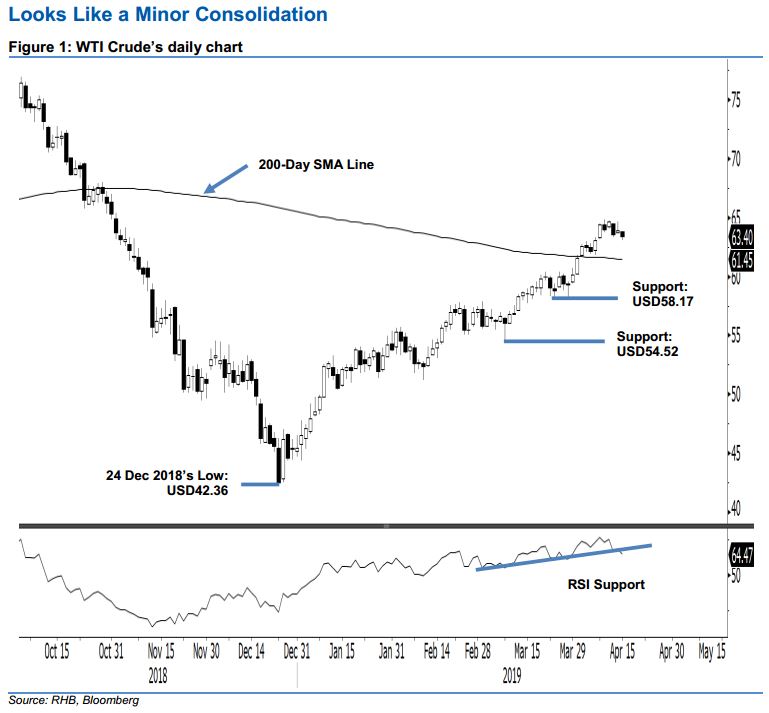

Maintain long positions. The black gold eased USD0.49 to close at USD63.40, session’s trading range was between USD63.03 and USD63.84. The commodity’s Daily RSI recently reached overbought readings. Since then, price actions over the recent sessions are resembling the characteristics of a minor consolidation ie no price exhaustion or reversal signals spotted. For now, as long as the commodity is still able to hold above the trailingstop (for our ongoing long positions) – which is also located near the 200-day SMA line – we would maintain our positive trading bias.

As the commodity’s upward move is still healthy, we continue to recommend traders stay in long positions. These were initiated at USD49.78, or the close of 8 Jan. For risk management purposes, a trailing-stop can be placed below the USD61.82 level – the low of 5 Apr.

Towards the downside, the immediate support is set at USD58.17, which was the low of 25 Mar. This is followed by USD54.52, or the low of 8 Mar. To the upside, the immediate resistance is set at USD66.86, which was the low of 7 Sep 2018. This is followed by USD70, a round figure.

Source: RHB Securities Research - 16 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024