Hang Seng Index Futures - Upside Move Likely to Continue

rhboskres

Publish date: Wed, 17 Apr 2019, 04:52 PM

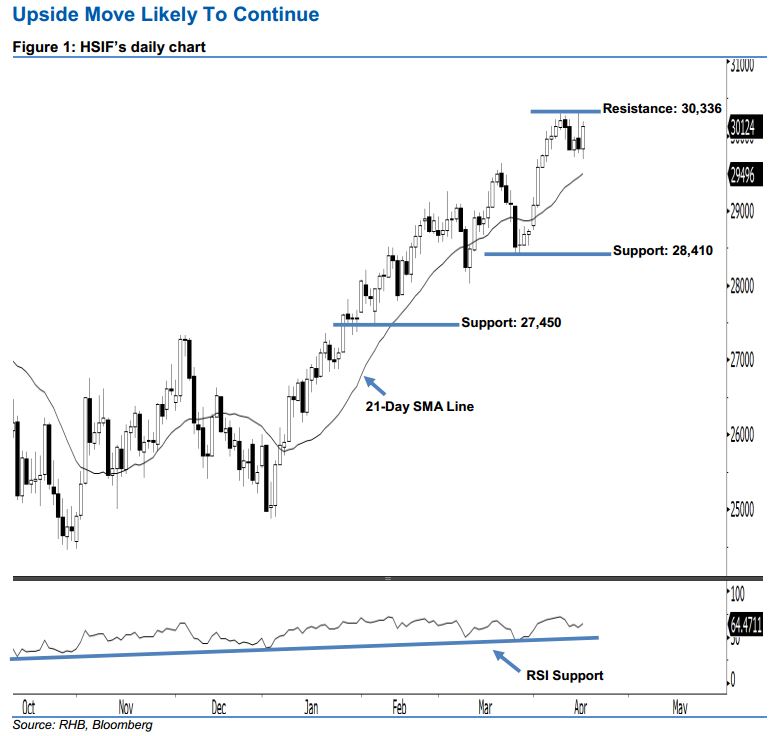

Stay long, with a trailing-stop set below the 28,410-pt support. The HSIF ended higher to form a white candle yesterday, pointing to a continuation of the upside move. It closed at 30,124 pts after oscillating between a high of 30,189 pts and low of 29,684 pts. On a technical basis, we expect the rebound that started from early-January to likely continue. This is because the HSIF has recouped the previous day’s losses and marked a higher close above the rising 21-day SMA line, implying that market sentiment is still considered bullish. Overall, we keep our bullish view on the HSIF’s outlook.

As seen in the chart, we anticipate the immediate support at 28,410 pts, ie the previous low of 26 Mar. The next support will likely be at 27,450 pts, ie the previous low of 8 Feb. On the other hand, the immediate resistance is now seen at 30,336 pts – this was obtained from the high of 15 Apr. If a breakout occurs, the next resistance is maintained at 31,544 pts, which was the previous high of 7 Jun 2018.

Consequently, we advise traders to maintain long positions, since we originally recommended initiating long above the 29,039-pt level on 20 Mar. A trailing-stop can be set below the 28,410-pt mark to limit the risk per trade.

Source: RHB Securities Research - 17 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024