E-mini Dow Futures - Outlook Remains Bullish

rhboskres

Publish date: Wed, 17 Apr 2019, 04:53 PM

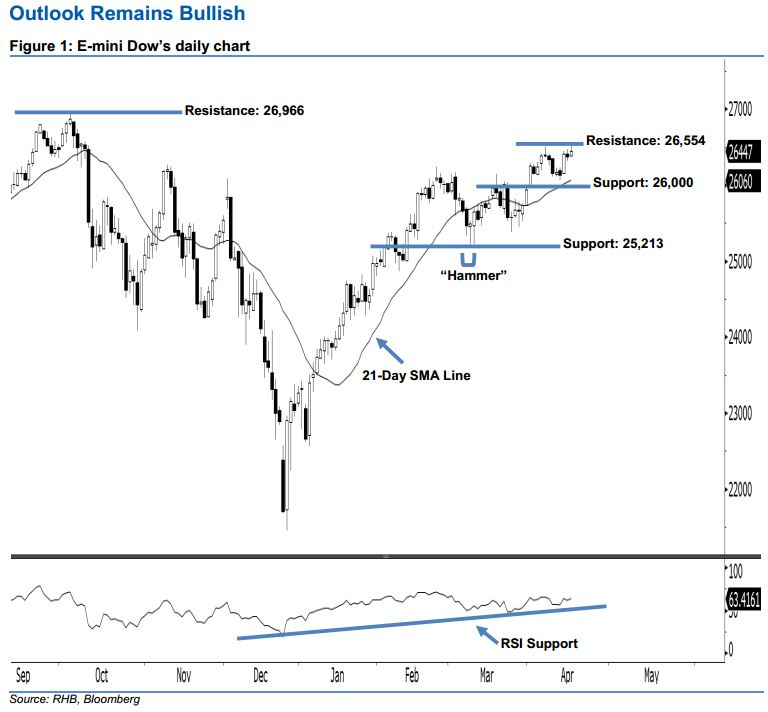

Maintain long positions. The E-mini Dow formed a white candle last night. It gained 74 pts to close at 26,447 pts, off its high of 26,554 pts and low of 26,377 pts. Market sentiment remained bullish, as the index has continued to stay above the rising 21-day SMA line. From a technical perspective, as long as the E-mini Dow does not negate the bullishness of 8 Mar’s “Hammer” pattern, there is a possibility that the upside swing will persist. Overall, we stay upbeat on the E-mini Dow’s outlook.

As seen in the chart, the immediate support is maintained at the 26,000-pt psychological mark. If a decisive breakdown arises, look to 25,213 pts – determined from the low of 8 Mar’s “Hammer” pattern – as the next support. On the other hand, we now anticipate the immediate resistance level at 26,554 pts, ie the high of 16 Apr. Meanwhile, the next resistance is seen at the 26,966-pt record high.

As a result, we advise traders to stay long, in line with our initial recommendation on 2 Apr to have long positions above the 26,000-pt level. In the meantime, a stop-loss set below the 25,213-pt threshold is advisable to limit the downside risk.

Source: RHB Securities Research - 17 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024