FCPO - No Sign Of End To Retracement Leg

rhboskres

Publish date: Wed, 17 Apr 2019, 04:57 PM

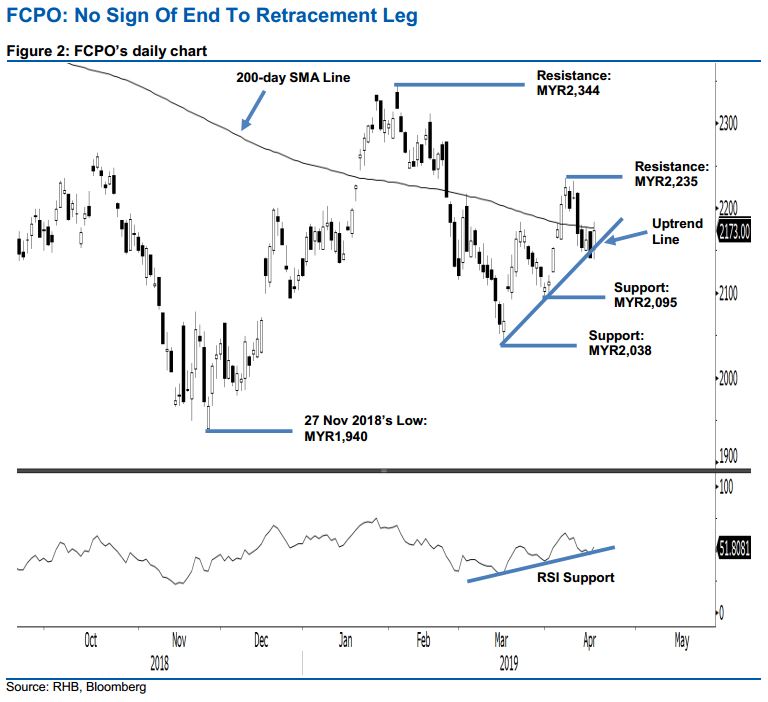

Maintain short positions. The FCPO formed a white candle in the latest session and in the process, tested the 200-day SMA line again. The commodity traded in the range of MYR2,139 and MYR2,184, before closing at MYR2,173, indicating a gain of MYR12. Despite the positive session, there is still no sufficient technical evidence to suggest that the commodity’s retracement leg has reached an end. This is further supported by the fact that it is still capped by the said SMA line. Towards the downside, a firm breach of the uptrend line (as drawn in the chart) is likely to flag the risk of a deeper retracement developing. Maintain our negative trading bias.

Until there are further positive signals to suggest the retracement has reached an end, we continue to recommend traders to stay in short positions. We initiated these positions at MYR2,154, the closing level of 11 Apr. To manage risks, a stop-loss can be placed above MYR2,235.

The immediate support is set at MYR2,095, the low of 29 Mar. Breaking this may see the market fall back to MYR2,038, the low of 15 Mar. On the other hand, the immediate resistance is pegged at MYR2,235, the high of 5 Apr. This is followed by MYR2,344, the high of 7 Feb.

Source: RHB Securities Research - 17 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024