COMEX Gold - Correction Mode Still

rhboskres

Publish date: Fri, 19 Apr 2019, 04:51 PM

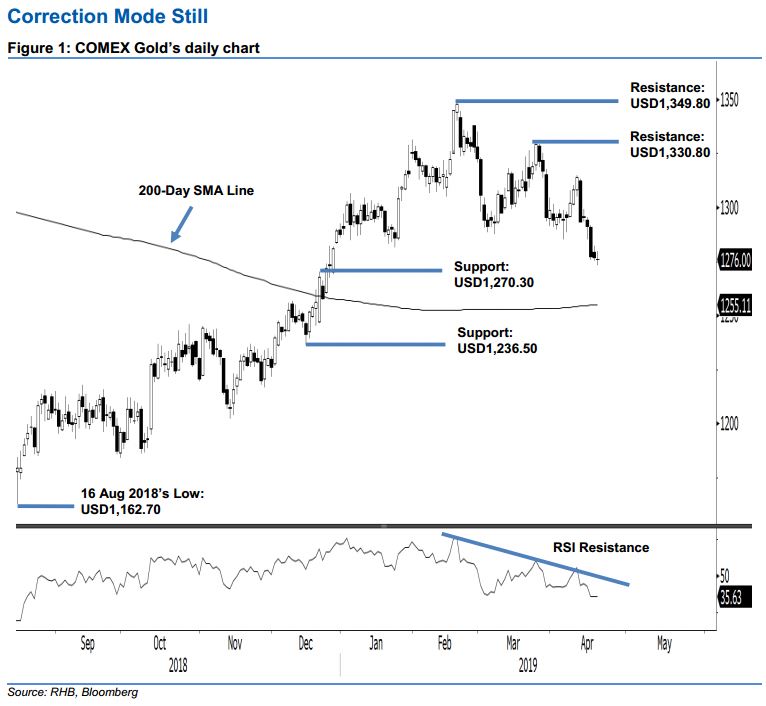

Maintain short positions while moving the trailing-stop to breakeven. The COMEX Gold moved slightly lower in the latest session – as it shed USD0.80 to settle at USD1,276. This was after it swung between a low and high of USD1,273 and USD1,279.70. Overall, the commodity’s correction phase, which started from the high of USD1,349.80 on 20 Feb, is still showing signs of developing. Towards the downside, we are still expecting the 200-day SMA line to be tested to complete the multi-week correction phase. Hence, we are keeping our negative trading bias.

As the bias is still tilted towards the downside test of the 200-day SMA line, we continue to recommend traders stay in short positions. We initiated these positions at USD1,291.30, the closing level of 12 Apr. For risk management purposes, a stop-loss can now be placed at the breakeven level.

Immediate support is eyed at USD1,270.30, which was the high of 20 Dec 2018. This is to be followed by USD1,236.50, the low of 14 Dec 2018. On the other hand, the immediate resistance is expected at USD1,330.80, which was the high of 25 Mar. This is followed by USD1,349.80, ie the high of 20 Feb.

Source: RHB Securities Research - 19 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024