E-mini Dow Futures - Moving Higher Steadily

rhboskres

Publish date: Fri, 19 Apr 2019, 04:54 PM

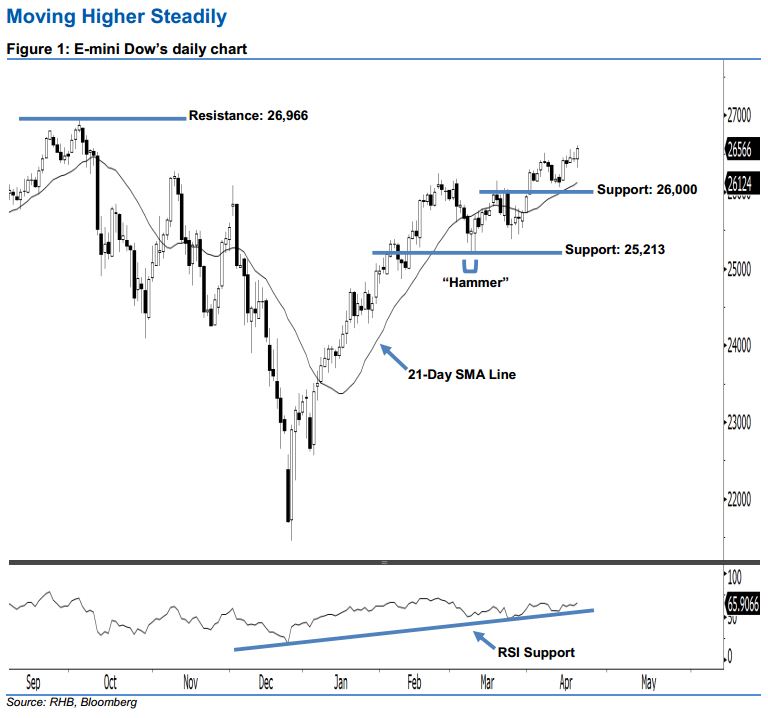

Stay long while setting a new trailing-stop below the 26,000-pt support. The upside strength of the E-mini Dow continued as expected, as a white candle was formed last night. It rose 138 pts to settle at 26,566 pts. As the E-mini Dow has breached above the previously-indicated 26,554-pt resistance, this can be viewed as the bulls extending their buying momentum. In view of the fact that the 21-day SMA line is likely to turn higher, this indicates that the upside swing, which began with 8 Mar’s “Hammer” pattern, may go on.

According to the daily chart, the immediate support is seen at the 26,000-pt round figure, which is also situated near the low of 11 Apr. If this level is taken out decisively, look to 25,213 pts – or the low of 8 Mar’s “Hammer” pattern – as the next support. To the upside, we now anticipate the resistance at the 26,966-pt record high. This is followed by the 27,000-pt psychological mark.

Recall that on 2 Apr we initially recommended traders to initial long positions above the 26,000-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 26,000-pt threshold as well. This is to minimise the downside risk.

Source: RHB Securities Research - 19 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024