Hang Seng Index Futures - Upward Momentum Resumes

rhboskres

Publish date: Mon, 22 Apr 2019, 08:37 AM

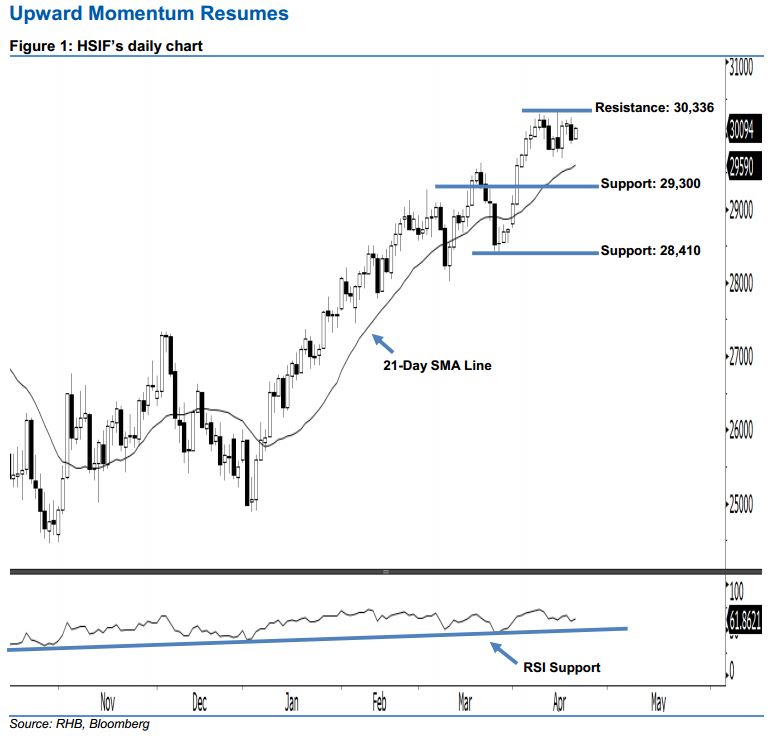

Maintain long positions. The HSIF’s buying momentum continued as expected. A white candle was posted during its latest session, which points to a continuation of the upside move. It closed at 30,094 pts, after oscillating between a high of 30,109 pts and low of 29,954 pts. We note that the index is still trading above the rising 21-day SMA line and the 29,300-pt support as mentioned previously, which suggest that the bullish sentiment remains unchanged. Overall, we expect the market to rise higher if the immediate 30,336-pt resistance is taken out decisively in the coming sessions.

Based on the daily chart, the immediate support is seen at 29,300 pts, set near the midpoint of 1 Apr’s long white candle. If a breakdown arises, look to 28,410 pts – which was the previous low of 26 Mar – as the next support. To the upside, we are eyeing the immediate resistance at 30,336 pts, determined from the high of 15 Apr. Meanwhile, the next resistance is seen at 31,544 pts, defined from the high of 7 Jun 2018.

Therefore, we advise traders to stay long, since we initially recommended initiating long above the 29,039-pt level on 20 Mar. A trailing-stop can be set below the 29,300-pt threshold in order to minimise downside risk.

Source: RHB Securities Research - 22 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024