FKLI - Waiting for Reversal Confirmation

rhboskres

Publish date: Mon, 22 Apr 2019, 08:57 AM

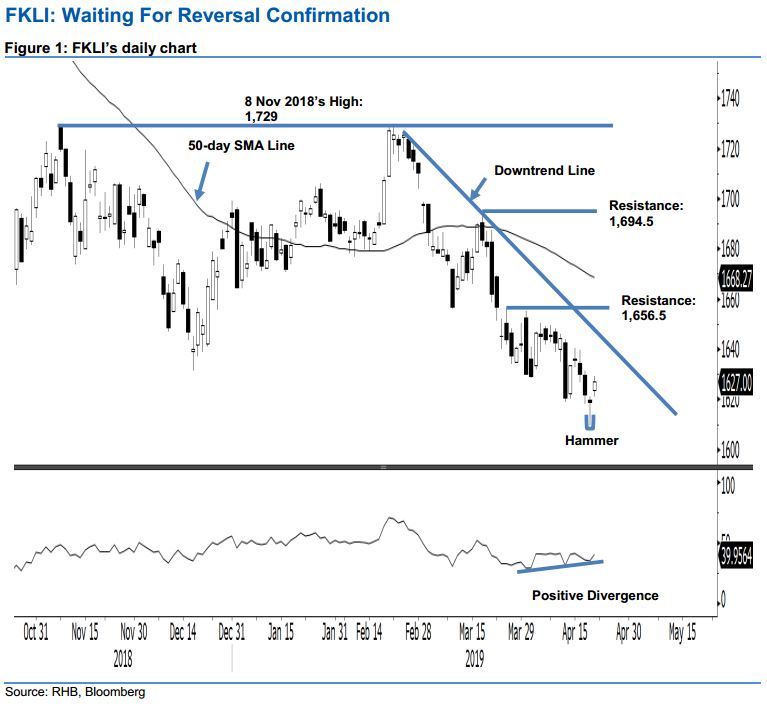

Maintain short positions until reversal is confirmed. The FKLI performed positively in the latest session. It gained 8 pts to close at 1,627 pts – the low and high were at 1,621 pts and 1,629 pts. The positive session came on the back of the “Hammer” formation in the prior session – this can be regarded as a minor rebound on the back of the recent retracement. For now, based on the daily chart, the 1,646-pt level (the trailing-stop for ongoing short positions) has yet to breach towards the upside. As such, the retracement leg that started from the high of 1,729 pts is still valid. Maintain our negative trading bias.

Pending a stronger price signal for a deeper rebound to develop, traders should remain in short positions. These were initiated at 1,698 pts, the closing level of 1 Mar. To manage risks, a stop-loss can be placed above 1,646 pts.

The immediate support is eyed at 1,600 pts. This is to be followed by 1,550 pts. Conversely, the immediate resistance is still expected to emerge at 1,656.5 pts, or the high of 26 Mar. This is followed by 1,694.5 pts, or the high of 19 Mar.

Source: RHB Securities Research - 22 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024