Hang Seng Index Futures - Still Bullish

rhboskres

Publish date: Tue, 30 Apr 2019, 05:48 PM

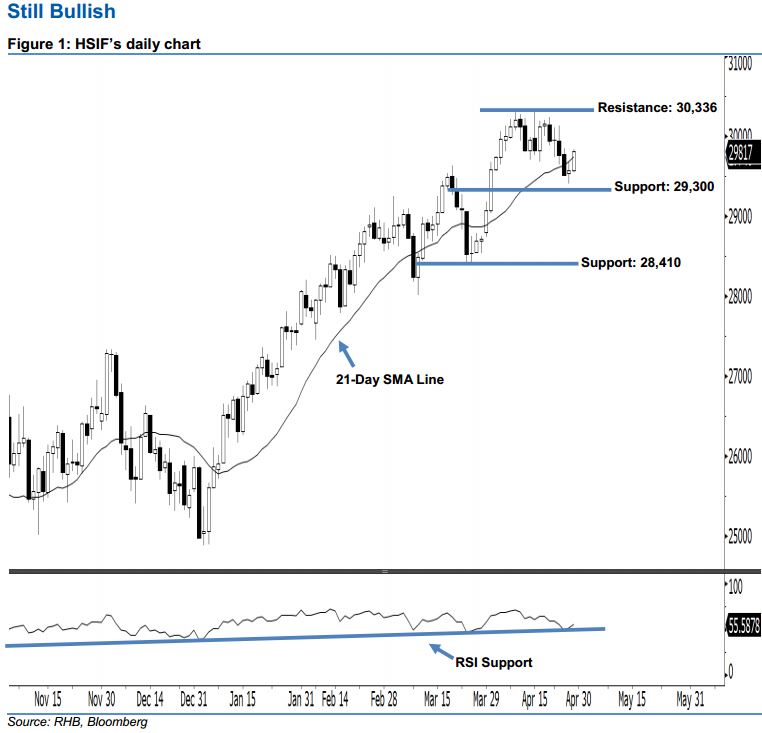

Stay long, with a trailing-stop set below the 29,300-pt support. The HSIF formed a white candle yesterday. It settled at 29,817 pts, after oscillating between a high of 29,835 pts and low of 29,547 pts. From a technical perspective, we think the bullish sentiment stays intact, as the index has climbed above the rising 21-day SMA line and continued to remain above the 29,300-pt support mentioned previously. Given that the 14-day RSI indicator rose above the 50 neutral point to flash a bullish reading at 55.58 pts, this would imply that the upside momentum is not yet diminished. As such, we stay bullish on the HSIF’s outlook.

Currently, the immediate support level is maintained at 29,300 pts, situated near the midpoint of 1 Apr’s long white candle. Meanwhile, the next support is seen at 28,410 pts, ie the previous low of 26 Mar. Towards the upside, we anticipate the immediate resistance level at 30,336 pts, which was the high of 15 Apr. If a decisive breakout occurs, look to 31,544 pts – ie the previous high of 7 Jun 2018 – as the next resistance.

Thus, we advise traders to stay long, in line with our initial recommendation to have long positions above the 29,039-pt level on 20 Mar. A trailing-stop can set below the 29,300-pt mark in order to limit the downside risk.

Source: RHB Securities Research - 30 Apr 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024