Hang Seng Index Futures - Sentiment Remains Bullish

rhboskres

Publish date: Fri, 03 May 2019, 05:38 PM

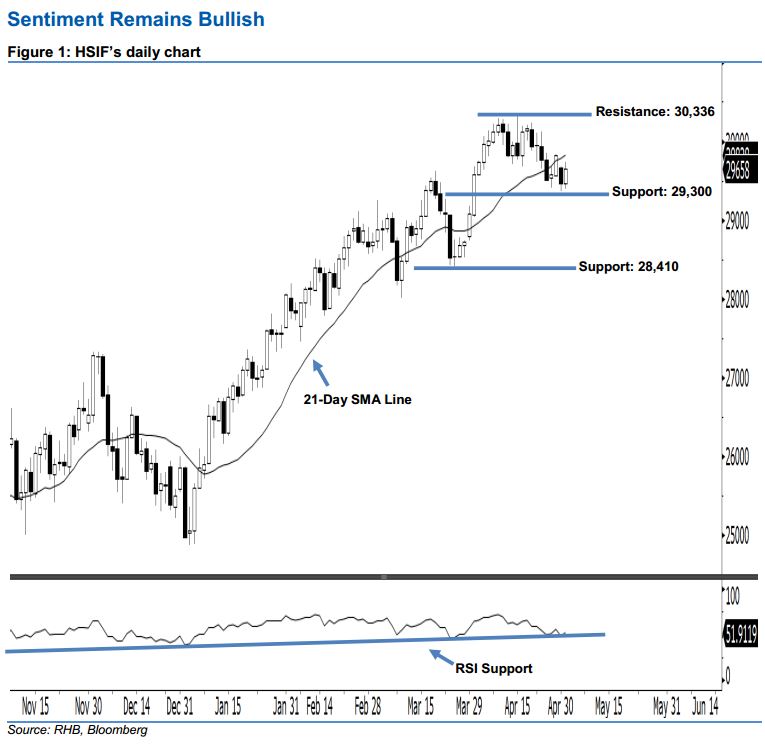

Stay long while setting a trailing-stop below the 29,300-pt support. The HSIF ended higher to form a white candle yesterday. It closed at 29,658 pts, after oscillating between a high of 29,737 pts and low of 29,391 pts. Based on the current technical landscape, we think the buyers may have retained control of the market. This was as yesterday’s white candle has recouped most of the previous session’s losses. As the 14-day RSI indicator recovered to a more positive reading at 51.91 pts, the bullish sentiment has improved. Overall, we remain upbeat in HSIF’s outlook.

As seen in the chart, the immediate support level is seen at 29,300 pts, ie near the midpoint of 1 Apr’s long white candle. The next support would likely be at 28,410 pts, determined from the low of 26 Mar. Towards the upside, we are eyeing the immediate resistance level at 30,336 pts, which was the high of 15 Apr. If this level is taken out decisively, look to 31,544 pts – ie the previous high of 7 Jun 2018 – as the next resistance.

Thus, we advise traders to stay long, since we had originally recommended initiating long above the 29,039-pt level on 20 Mar. A trailing-stop can be set below the 29,300-pt threshold in order to limit the downside risk.

Source: RHB Securities Research - 3 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024