COMEX Gold - a Possible Bounce

rhboskres

Publish date: Mon, 06 May 2019, 10:09 AM

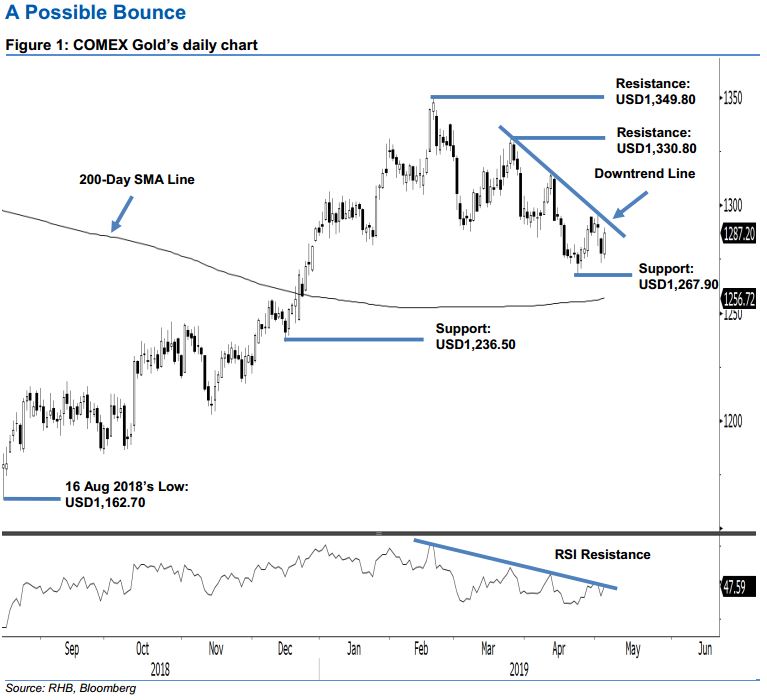

Maintain long positions on expectations of a rebound play. The COMEX Gold added USD9.40 to settle at USD1,287.20, after the precious metal managed to reverse its intraday loss towards the end of the session. The low and high were at USD1,275 and USD1,289.70. Overall, the rebound that started from the low of USD1,267.90 on 23 Apr is still in place and may be extending. Towards the upside, should the downtrend line (as drawn in the chart) be broken, chances are high that the commodity may be resuming its long-term upward price trend, which started from the low of USD1,162.70 on 16 Aug 2018. We maintain our positive trading bias.

As the commodity is still showing good signs of rebounding, we continue to recommend traders to stay in long positions. These were initiated at USD1,290.20, which was the closing level of 1 May. A stop-loss can be placed below the USD1,267.90 level.

The immediate support is expected to emerge at USD1,267.90, or the low of 23 Apr. The second support may be found at USD1,236.50, ie the low of 14 Dec 2018. On the flip side, the immediate resistance is set at USD1,330.80, which was the high of 25 Mar. This is followed by USD1,349.80, or the high of 20 Feb.

Source: RHB Securities Research - 6 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024