WTI Crude Futures - 200-Day SMA Under Stress

rhboskres

Publish date: Tue, 07 May 2019, 04:47 PM

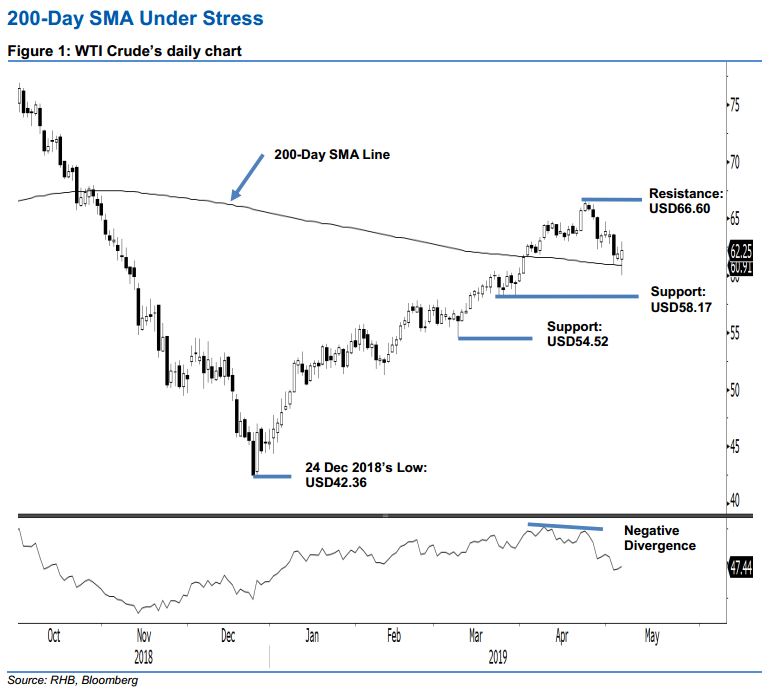

The 200-day SMA line is on the defensive; stay in short positions. The WTI Crude ended the latest session on the positive side, as it managed to reverse its earlier session’s loss – at one point, this saw the 200-day SMA line briefly breached. The session’s low and high were posted at USD60.04 and USD62.95, before ending USD0.31 higher at USD62.25. While the SMA line has still managed to hold up, based on the latest price action, there are still no strong indications to suggest a total reversal is taking place. We are expecting the ongoing correction phase, which started from the recent high of USD66.60, to extend. We also maintain our negative trading bias.

As the correction phase is still considered as being in the early stages of development, we stick with our recommendation for traders to stay in short positions. These were initiated at USD61.81, or the closing level of 2 May. For risk-management purposes, a stop-loss can be placed above the USD66.60 level.

The support level may be found at USD58.17, or the low of 25 Mar. This is followed by USD54.52, which was the low of 8 Mar. Conversely, the immediate resistance is set at USD66.60, ie the low of 7 Sep 2018. This is followed by USD70, a round figure.

Source: RHB Securities Research - 7 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024