Hang Seng Index Futures - Downside Swing Stays Intact

rhboskres

Publish date: Wed, 08 May 2019, 05:40 PM

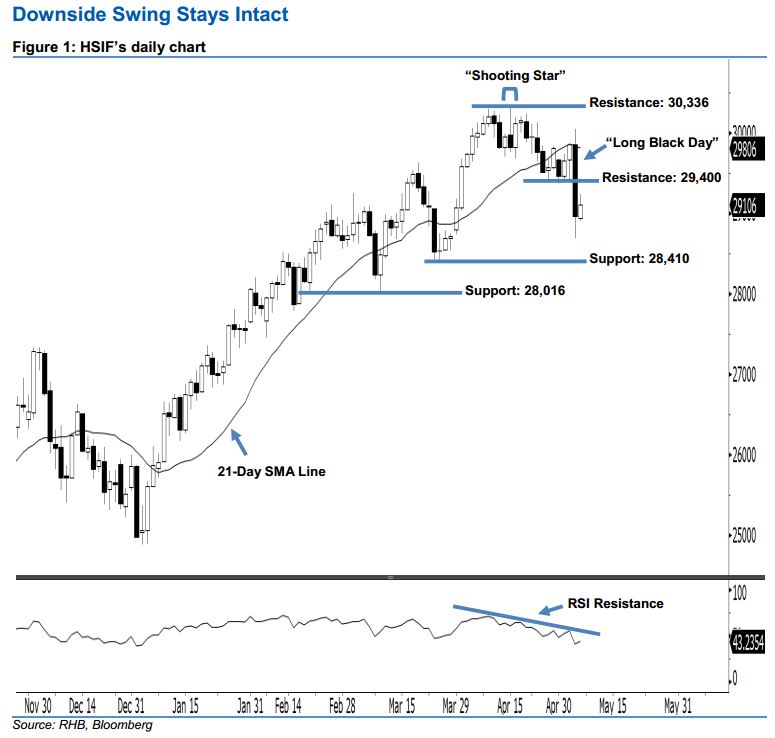

Stay short, with a stop-loss set above the 30,336-pt resistance. After posting a long black candle, the HSIF ended higher to form a white candle yesterday. It settled at 29,106 pts after oscillating between a high of 29,242 pts and low of 28,909 pts. Unsurprisingly, yesterday’s white candle should merely be viewed as a technical rebound following the recent plunge. Technically, we think the bulls may continue to control the market, as long as the index does not negate the bearishness of 15 Apr’s “Shooting Star” pattern. Overall, we keep our bearish view on the HSIF’s outlook.

According to the daily chart, the immediate resistance is seen at 29,400 pts, ie near the midpoint of 6 May’s “Long Black Day” candle. Meanwhile, the next resistance is maintained at 30,336 pts, which was obtained from the high of 15 Apr’s “Shooting Star” pattern. To the downside, we maintain the near-term support at 28,410 pts, or the low of 26 Mar. This is followed by 28,016 pts, which was defined from the previous low of 11 Mar.

Therefore, we advise traders to stay short, in line with our initial recommendation on 7 May to have short positions below the 29,400-pt level. A stop-loss can be set above the 30,336-pt mark to limit the risk per trade.

Source: RHB Securities Research - 8 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024