WTI Crude Futures - Testing 200-Day SMA Again

rhboskres

Publish date: Wed, 08 May 2019, 05:43 PM

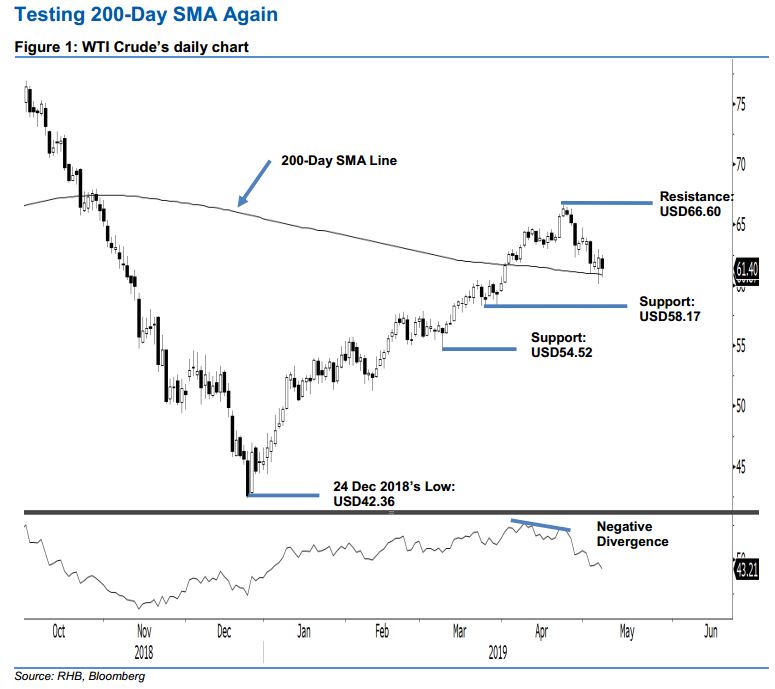

Maintain short positions as the 200-day SMA is under persistent threat. The bears again tested the black gold’s 200-day SMA line in the latest trade. The commodity registered a low and high of USD60.66 and USD62.49, before closing USD0.85 lower at USD61.40. We are keeping our bias that at the minimum, the commodity is in the process of developing an intermediate-term correction phase. This is to correct its prior multimonth upward move (that started from the low of USD42.36 on 24 Dec 2018), which reached an overbought Daily RSI reading and flashed out negative divergence about two weeks ago.

As the said correction is likely to extend, we remain with our recommendation for traders to stay in short positions. These were initiated at USD61.81, or the closing level of 2 May. For risk-management purposes, a stop-loss can be placed above the USD66.60 level.

The support level is expected at USD58.17, or the low of 25 Mar. This is followed by USD54.52, which was the low of 8 Mar. Moving up, the immediate resistance is set at USD66.60, ie the low of 7 Sep 2018. This is followed by USD70, a round figure.

Source: RHB Securities Research - 8 May 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024