Hang Seng Index Futures - Snaps Four-Day Winning Streak

rhboskres

Publish date: Mon, 24 Jun 2019, 11:13 AM

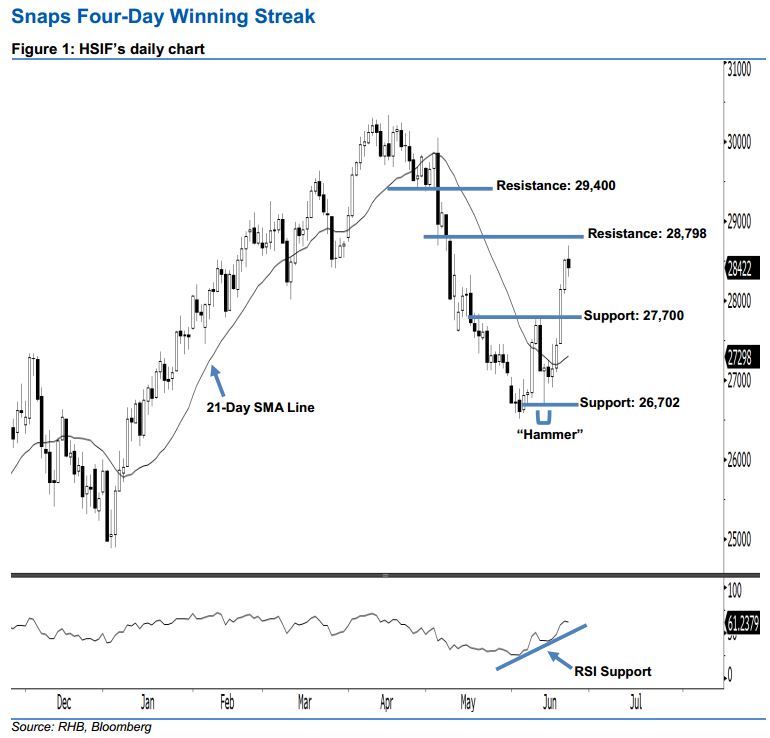

Stay long while setting a new trailing-stop below the 27,700-pt support. Following the white candles that were formed on 17-20 Jun, the HSIF ended lower to form a black candle yesterday. During the intraday session, it declined to a low of 28,298 pts before ending at 28,422 pts for the day. Unsurprisingly, Last Friday’s black candle should merely be viewed as a weak pullback following the recent surge. Technically speaking, we believe the bulls may continue to control the market as long as the HSIF does not erase more than 50% of the gains created by 19 Jun’s long white candle. Overall, we keep our bullish view on the HSIF’s outlook.

Presently, the immediate support level is maintained at 27,700 pts, situated near the midpoint of 19 Jun’s long white candle. If a breakdown arises, look to 26,702 pts – determined from the low of 13 Jun’s “Hammer” pattern – as the next support. Towards the upside, we are eyeing the immediate resistance level at 28,798 pts, ie the high of 9 May. The next resistance is set at 29,400 pts, ie near the midpoint of 6 May’s long black candle.

Recall that on 12 Jun, we initially recommended traders to initiate long positions above the 27,436-pt level. We continue to advise them to stay long for now, while setting a new trailing-stop below the 27,700-pt mark. This is in order to lock in part of the gains.

Source: RHB Securities Research - 24 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024