FCPO - Negative Bias Remains

rhboskres

Publish date: Tue, 23 Jul 2019, 10:05 AM

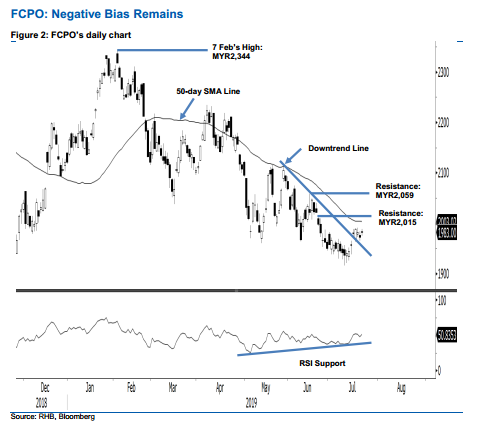

Maintain short positions as there are no indications for a change in the negative bias. The FCPO performed positively in the latest trade. At the closing, the soft commodity added MYR11 to settle at MYR1,983. This was after it reached a low and high of MYR1,975 and MYR1,989. Despite the positive performance, it still lacked technical evidence to suggest the commodity’s weak bias has reached an end, and that it is poised to stage a strong countertrend rebound. Towards the upside, the rebound may only extend further if the 50-day SMA line is breached decisively. Until this happens, we stay with our negative trading bias.

As the bulls are still struggling to show control over the price trend, we continue to recommend that traders stay in short positions. These were initiated at MYR1,951, the closing level of 28 Jun. We revise the stop-loss to above MYR2,015.

We are keeping the immediate support at the MYR1,900 threshold. This is followed by MYR1,863, the low of 25 Aug 2015. Meanwhile, the immediate resistance is expected to emerge at MYR2,015, near the high of 24 Jun. This is followed by the MYR2,059 threshold, the high of 18 Jun.

Source: RHB Securities Research - 23 Jul 2019