Hang Seng Index Futures - Support Sits at 28,052 Pts

rhboskres

Publish date: Mon, 29 Jul 2019, 12:14 PM

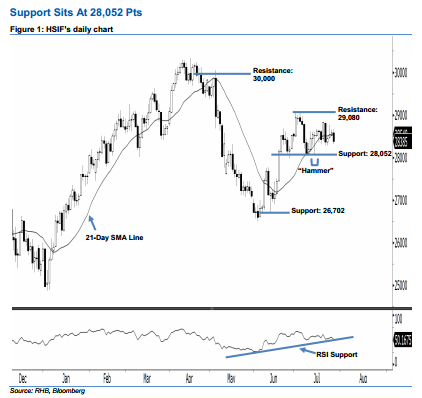

Outlook remains positive; stay long. The HSIF ended lower to form a black candle last Friday. It closed at 28,385 pts, after oscillating between a high of 28,663 pts and low of 28,311 pts. Technically speaking, last Friday’s black candle should be viewed as a result of profit-taking activities following recent gains. Given that the index failed to negate the bullishness of 15 Jul’s “Hammer” pattern, there is a possibility that the upside swing would persist. Overall, we stay bullish on the HSIF’s outlook.

As seen in the chart, the immediate support is anticipated at 28,052 pts, ie the low of 15 Jul’s “Hammer” pattern. If the price breaks down, the next support is seen at 26,702 pts, which was the previous low of 13 Jun. To the upside, we are eyeing the immediate resistance at 29,080 pts, ie 4 Jul’s high. Meanwhile, the next resistance is situated at the 30,000-pt psychological mark, set near the high of 6 May’s long black candle as well.

Therefore, we advise traders to stay long, given that we initially recommended initiating long above the 27,436-pt level on 12 Jun. A trailing stop is advisable below the 28,052-pt mark in order to secure part of the gains.

Source: RHB Securities Research - 29 Jul 2019