COMEX Gold - Trading in Consolidation Mode

rhboskres

Publish date: Fri, 02 Aug 2019, 05:10 PM

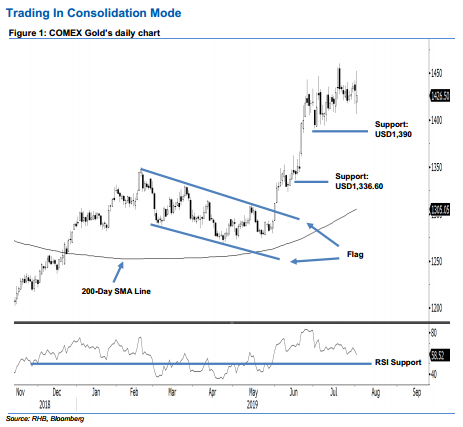

Maintain long positions as the commodity is still showing signs of consolidating. The precious metal registered a wide swing in the latest session. The low and high were posted at USD1,406.20 and USD1,452.30, this was before it ended USD5.30 lower at USD1,426.50. The commodity’s price actions over the recent weeks are indicating a multi-week consolidation phase is still developing – to correct its previous sharp upward move, which reached an overbought Daily RSI reading in June. Once this consolidation phase is completed, the commodity may resume its upward move. Maintain our positive trading bias.

Given that the yellow metal is still showing signs of extending its multi-week consolidation phase – instead of a sharp reversal, we retain our recommendation for traders to stay in long positions. We opened these positions at USD1,333.60, which was the closing level for 5 Jun. For risk management purposes, a stop-loss can now be placed below the USD1,390 mark.

We are keeping the immediate support target at USD1,390, or near the low of 1 Jul. This is followed by USD1,336.60, which was the low of 17 Jun. Towards the upside, the immediate resistance is set at the USD1,500 threshold. This is followed by the USD1,550 level.

Source: RHB Securities Research - 2 Aug 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024