WTI Crude Futures - Getting Thrashed by the 200-Day SMA

rhboskres

Publish date: Fri, 02 Aug 2019, 05:12 PM

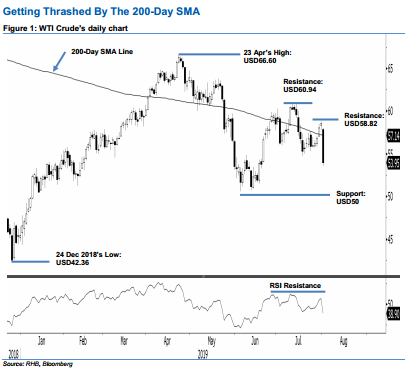

Bulls are rejected from the 200-day SMA line again; maintain short positions. The WTI Crude formed a long black candle in the process breached below both the 200-day SMA line and the previous immediate support level of USD54.84. Session’s low and high were recorded at USD53.59 and USD57.99, before closing USD4.63 weaker at USD53.95. The commodity has been struggling to overcome the said SMA since end-June. With the said breakdown from the SMA, the overall weak bias that started from the high of USD60.94 on 1 Jul is still firmly in place. Maintain our negative trading bias.

With the retracement phase still showing signs of developing, we continue to recommend traders stay in short positions. We initiated these at USD55.30, which was the closing level of 19 Jul. For risk management purposes, a stop-loss can now be placed above the USD58.82 mark.

Immediate support is revised to USD50, a round figure. This is followed by USD45. On the other hand, the immediate resistance is now expected at USD58.82, which was the high of 31 Jul. This is followed by USD60.94, high of 1 Jul.

Source: RHB Securities Research - 2 Aug 2019