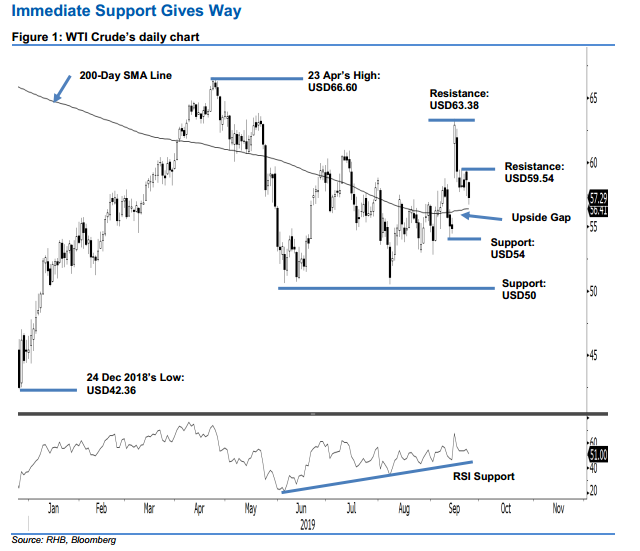

WTI Crude Futures: Immediate Support Gives Way

rhboskres

Publish date: Wed, 25 Sep 2019, 04:55 PM

Maintain long positions as the trailing-stop is still holding up. The WTI Crude ended the latest session on a weak tone – at the closing it breached below the previous immediate support of USD57.47. Session’s low and high were posted at USD56.69 and USD58.49, before closing at USD57.29, indicating a decline of USD1.35. The giving away of the said previous immediate support came after the commodity experienced price retracement over the recent sessions. This suggests there is no positive follow-up for the 16 Sep’s “Upside Gap”. However, for now, provided the trailing-stop for our ongoing long position of USD57.10 is not breached, we would keep to our positive trading bias. As we still see the upward move that started from the area near the USD50 level as still intact, we continue to recommend traders stay in long positions. We initiated these at USD57.10, or the closing level of 13 Aug. For risk-management purposes, a stop loss can now be placed at the breakeven mark. Immediate support is revised to USD54, the low of 12 Sep. This is followed by USD50, a round figure. Conversely, immediate resistance is now expected at USD59.54, the high of 19 Sep. This is followed by USD63.38, the high of 16 Sep

Source: RHB Securities Research - 25 Sept 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024