WTI Crude Futures: Sharp Intraday Rebound

rhboskres

Publish date: Fri, 04 Oct 2019, 09:22 AM

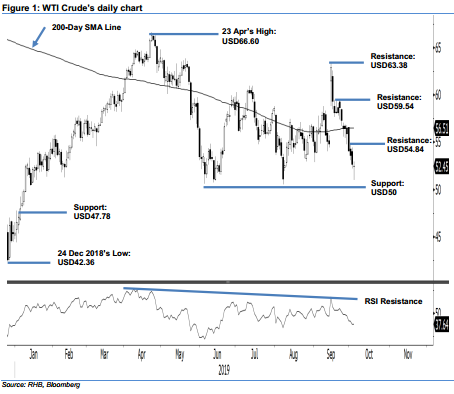

Maintain short positions while keeping the trailing-stop tighter. The WTI Crude staged a sharp intraday reversal in the latest session. It reached a low of USD50.99 before rebounding to settle USD0.19 lower at USD52.45. The strong reaction from an area not too far from USD50 support level – which has been tested twice since June – is suggesting the retracement from the high of USD63.38 may be reaching an end. Positive price actions in the coming sessions are important to confirm this possibility. Until this happens, we keep to our negative trading bias.

Until a clearer signal to mark the end of the commodity’s recent retracement emerges, traders are advised to stay in short positions. We initiated these at USD56.49, the closing level of 25 Sep. For risk-management purposes, a stop loss can now be placed at above USD53.

Immediate support is kept at USD50, a round figure. This is followed by USD47.78, which was the high of 2 Jan. Moving up, immediate resistance is at USD54.84, the high of 1 Oct. This is followed by USD59.54, the high of 19 Sep

Source: RHB Securities Research - 4 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024