FKLI - Tightening Up Trailing Stop

rhboskres

Publish date: Mon, 07 Oct 2019, 10:12 AM

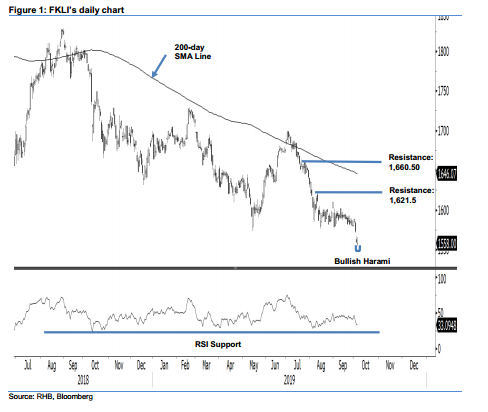

Maintain short positions while keeping risk management tighter. The FKLI formed a “Doji” pattern in the latest session. This came after it reached a low and high of 1,554.5 pts and 1,565.5 pts, before closing 2 pts lower at 1,558 pts. The appearance of the “Doji” pattern points to indecisiveness – and this came after it experienced a breakdown from its 1.5-month sideways movement in the prior two sessions.

While this can be an early sign that the index’s downward move may have reached an interim low, further positive price actions are needed to confirm this. Towards the upside, we are looking at the upside breach of 1,566.5 pts (the high of 3 Oct) as the required price confirmation. Until this happens, we maintain our negative trading bias. While waiting for the bulls to signal for a rebound, traders are advised to remain in short positions. We initiated these at 1,668 pts, or the closing level of 12 Jul. To manage risks, a stop-loss can be placed above 1,566.5 pts

Immediate support is set at the 1,550-pt mark, followed by 1,500 pts. On the other hand, immediate resistance is now set at 1,600-pt level, followed by 1,621.5 pts, the high of 9 Aug.

Source: RHB Securities Research - 7 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024