COMEX Gold : a Minor Pause

rhboskres

Publish date: Mon, 07 Oct 2019, 10:15 AM

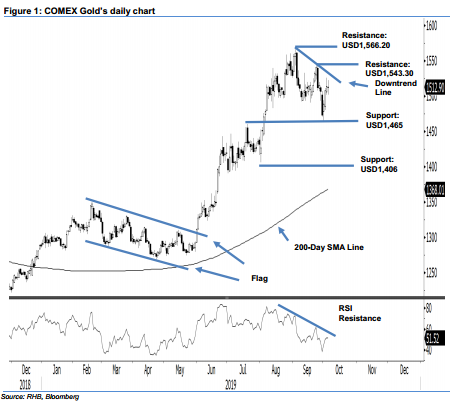

Maintain long positions on the expectation the multi-week correction has completed. The COMEX Gold eased USD0.90 to end the latest session at USD1,512.90. Trading continued to take place above the USD1,500 mark, in the range of USD1,501.40 and USD1,522.20. The soft session can be seen as a sign of the bulls taking a minor pause after the commodity experienced a relatively good upward move from the USD1,465 immediate support level over the last three sessions. Overall, the bias is encouraging, and the COMEX Gold is on the path to extend its upward move. This bias could be further enhanced if the downtrend line (as drawn on the chart) is crossed. We maintain our positive trading bias.

As the bias is still constructive, we continue to recommend traders stay in long positions – these were initiated at USD1,513.80, or the closing level of 3 Oct. For risk-management purposes, a stop loss can be placed below the USD1,465 threshold.

The immediate support is kept at USD1,465, which was the low of 1 Oct. This is followed by the USD1,406 mark, ie near the low of 1 Aug. Meanwhile, the immediate resistance is set at USD1,543.30, or the high of 24 Sep. This is followed by USD1,566.20, which was the high of 4 Sep.

Source: RHB Securities Research - 7 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024