E-mini Dow Futures - Negative Bias Remains Intact

rhboskres

Publish date: Tue, 08 Oct 2019, 10:06 AM

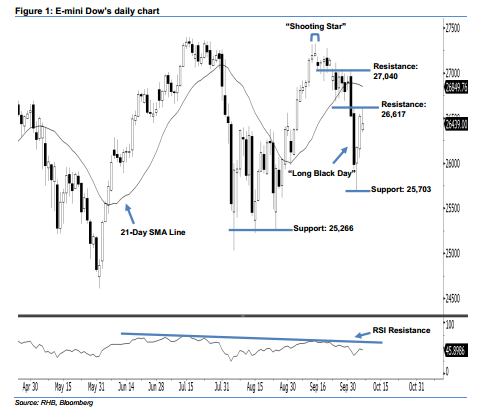

Stay short, provided that the 26,617-pt resistance is not violated at closing. The E-mini Dow formed a white candle with a long upper shadow last night. It surged to a high of 26,615 pts during the intraday session, before ending at 26,439 pts for the day. However, it is not surprising that sellers may be taking a pause following the recent losses. Technically speaking, yesterday’s long upper shadow shows that there was buying momentum during the day, before the market pushed it down by the end of the trading session. This implies that the market outlook was still negative.

As seen in the chart, we anticipate the immediate resistance level at 26,617 pts, which was the high of 2 Oct’s “Long Black Day” candle. The next resistance level is seen at 27,040 pts, ie near the highs of 23 Sep, 26 Sep, and 1 Oct. Towards the downside, the immediate support level is maintained at 25,703 pts, which was the previous low of 3 Oct. If this level is taken out, look to 25,266 pts – obtained from the low of 26 Aug – as the next support.

Hence, we advise traders to stay short, in line with our initial recommendation to have short positions below the 26,780-pt level on 2 Oct. A trailing stop set above the 26,617-pt mark is preferable to minimise the risk per trade.

Source: RHB Securities Research - 8 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024