COMEX Gold - Upside Bias Still Intact

rhboskres

Publish date: Wed, 09 Oct 2019, 06:13 PM

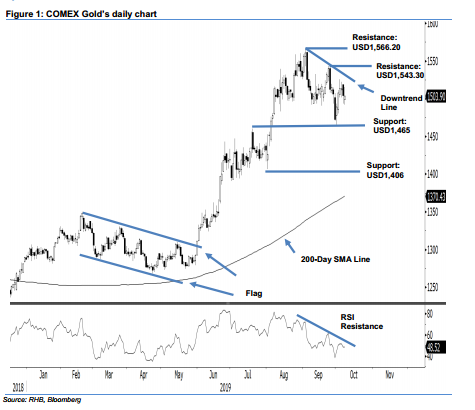

Maintain long positions, on the bias that the commodity is staging an upward extension. The COMEX Gold was little changed in the latest session, easing USD0.50 to close at USD1,503.90. The trading range was relatively wide, between USD1,492.10 and USD1,515.30. We still believe the commodity has completed its multiweek correction, marked by the USD1,465 low on 1 Oct – implying that its upward move is likely to extend. This bias could be further enhanced should the downtrend line (as drawn on the chart) be breached. We maintain our positive trading inclination.

As we see the recent sessions’ price actions as the staging ground for the bulls for the next up-leg, we continue to recommend traders stay in long positions – these were initiated at USD1,513.80, or the closing level of 3 Oct. For risk-management purposes, a stop loss can be placed below the USD1,465 threshold.

The immediate support is still pegged at USD1,465, which was the low of 1 Oct. This is followed by the USD1,406 mark, ie near the low of 1 Aug. Meanwhile, the immediate resistance is set at USD1,543.30, or the high of 24 Sep. This is followed by USD1,566.20, which was the high of 4 Sep.

Source: RHB Securities Research - 9 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024