Hang Seng Index Futures - Sentiment Remains Negative

rhboskres

Publish date: Wed, 09 Oct 2019, 06:19 PM

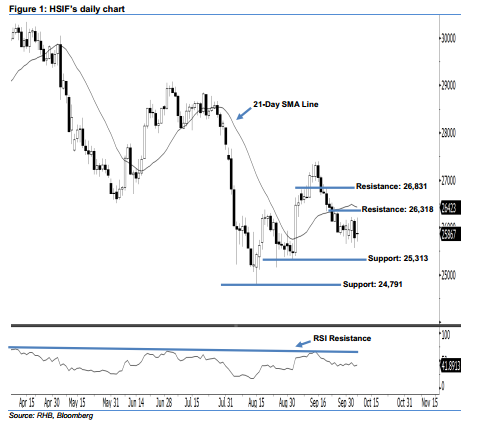

Bearish sentiment remains intact; maintain short positions. The HSIF formed a “Doji” candle yesterday. It closed at 25,867 pts after oscillating between a high of 26,202 pts and low of 25,693 pts. Still, the bearish sentiment stays unchanged, as this candle can only be viewed as sellers probably taking a pause after the recent drop. The 21-day SMA line is now likely to turn downwards, suggesting additional selling pressure may be present in the coming sessions. Overall, we think the market downside swing that began with 16 Sep’s black candle may persist.

As seen in the chart, we are eyeing the immediate resistance level at 26,318 pts – this was determined from 25 Sep’s high. The next resistance is anticipated at 26,831 pts, ie the high of 19 Sep’s black candle. Towards the downside, the immediate support level is seen at 25,313 pts, which was the low of 3 Sep. If this level is taken out, look to 24,791 pts – obtained from the previous low of 15 Aug – as the next support.

Hence, we advise traders to stay short, following our recommendation of initiating short below the 26,318-pt level on 2 Oct. In the meantime, a stop-loss can be set above the 26,831-pt threshold to limit the risk per trade

Source: RHB Securities Research - 9 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024