E-mini Dow Futures - a Weak Rebound

rhboskres

Publish date: Thu, 10 Oct 2019, 05:06 PM

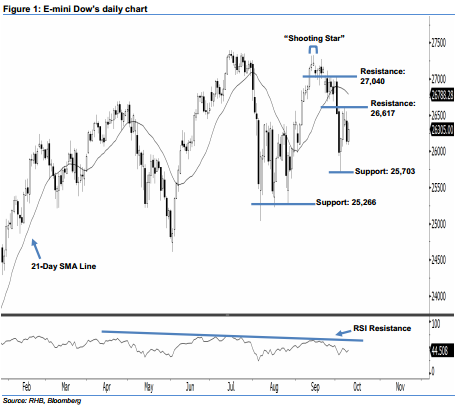

Stay short while setting a trailing stop above the 26,617-pt resistance. The E-mini Dow formed a white candle last night. It gained 167 pts to close at 26,305 pts after oscillating between a high of 26,400 pts and low of 26,086 pts. From a technical viewpoint, yesterday’s white candle should merely be viewed as a technical rebound following the previous day’s losses. We think the bears may continue to control the market as long as the E-mini Dow does not recoup the losses created by 2 Oct’s long black candle. As the 21-day SMA line is still pointing downwards, we believe the selling momentum is not over.

We maintain the immediate resistance level at 26,617 pts, which was defined from the high of 2 Oct’s long black candle. The next resistance is seen at 27,040 pts, ie near the highs of 23 Sep, 26 Sep, and 1 Oct. Towards the downside, the immediate support level is seen at 25,703 pts, which is set at the previous low of 3 Oct. If a decisive breakdown arises, look to 25,266 pts – obtained from the low of 26 Aug – as the next support. Therefore, we advise traders to maintain short positions, since we had originally recommended initiating short positions below the 26,780-pt level on 2 Oct. A trailing stop set above the 26,617-pt mark is preferable to limit the risk per trade.

Source: RHB Securities Research - 10 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024