WTI Crude Futures - No Reversal Signal Yet

rhboskres

Publish date: Thu, 10 Oct 2019, 05:09 PM

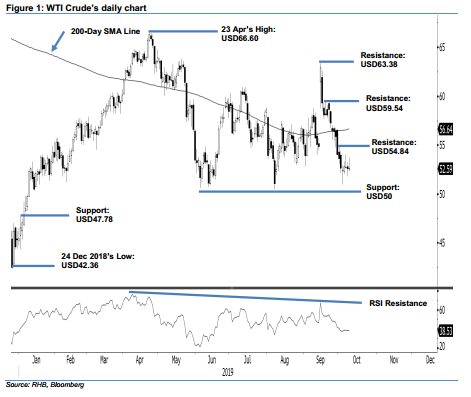

No signal for a stronger rebound yet; maintain short positions. The WTI Crude returned its earlier session’s gains to settle marginally lower by USD0.04 at USD52.59. The low and high were posted at USD52.31 and USD53.74. The inability of the black gold to retain its gains and sit above the USD53.00 level suggests there is still no clear technical evidence that a stronger rebound is ready to develop. All in, the retracement that started from the USD63.38 mark on 16 Sep is considered as still in progress – as the rebound from an area near the USD50.00 support mark recently is still considered small. Hence, we keep our negative trading bias.

Without clear price signals to indicate the bulls are ready to push for a stronger rebound, traders are advised to stay in short positions. We initiated these at USD56.49, which was the closing level of 25 Sep. For riskmanagement purposes, a stop loss can now be placed above the USD53.00 mark.

The immediate support is set at USD50.00, a round figure. This is followed by USD47.78, which was the high of 2 Jan. On the other hand, the immediate resistance is at USD54.84, or the high of 1 Oct. This is followed by USD59.54, ie the high of 19 Sep.

Source: RHB Securities Research - 10 Oct 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024