RHB Retail Research

E-mini Dow Futures - Taking a Breather

rhboskres

Publish date: Thu, 19 Dec 2019, 10:18 AM

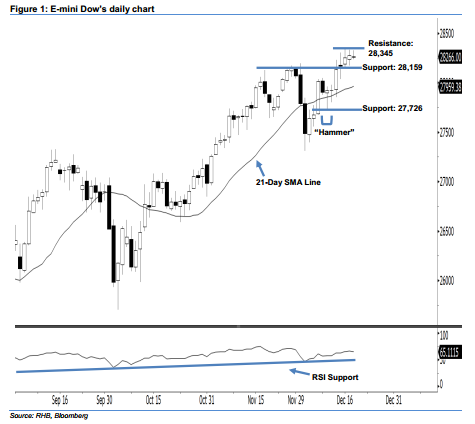

Stay long, with a stop-loss set below the 27,726-pt support. The E-mini Dow formed a “Doji” candle last night. It settled at 28,266 pts, after oscillating between a high of 28,327 pts and low of 28,238 pts. Yet, we maintain our bullish outlook, as the index is still trading above the rising 21-day SMA line. Yesterday’s candle can merely be viewed as a slight pullback, in our view. Overall, we think the rebound that began with 10 Dec’s “Hammer” pattern will likely persist in the coming sessions.

As seen in the chart, the immediate support level is seen at 28,159 pts – this was determined from the low of 16 Dec. If this level is taken out, look to 27,726 pts – the low of 10 Dec’s “Hammer” pattern – as the next support. To the upside, we now eye the immediate resistance level at the 28,345-pt historical high. The next resistance will likely be at the 28,500-pt round figure.

Hence, we advise traders to maintain long positions, since we originally recommended initiating long above the 28,159-pt level on 17 Dec. Meanwhile, a stop-loss set below the 27,726-pt threshold is advisable to limit the downside risk.

Source: RHB Securities Research - 19 Dec 2019

More articles on RHB Retail Research

Duopharma Biotech - Lacking Near-Term Re-Rating Catalysts; D/G NEUTRAL

Created by rhboskres | Aug 26, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments