WTI Crude Futures - No Breakaway Yet

rhboskres

Publish date: Tue, 07 Jan 2020, 11:28 AM

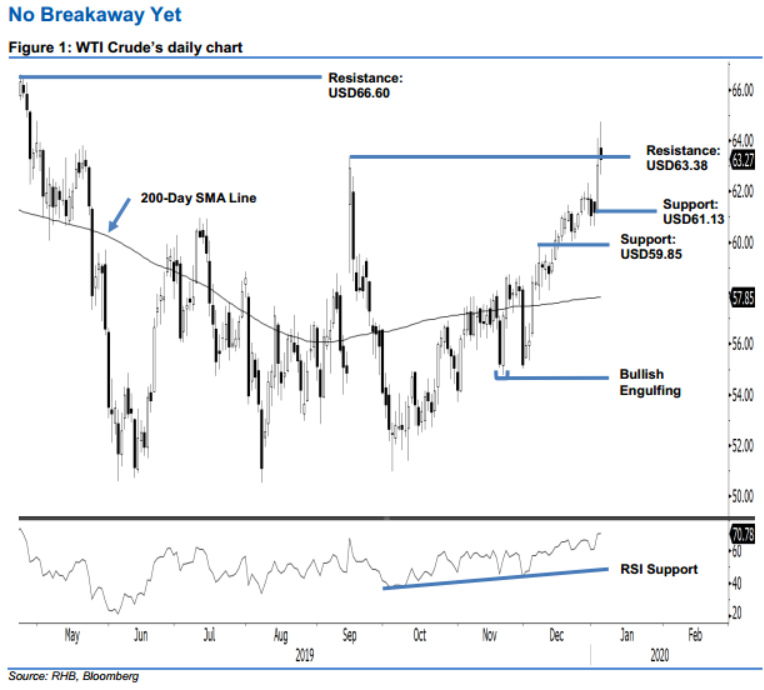

Maintain long positions. The WTI Crude tested the immediate resistance of USD63.38 during the latest session. It reached an intraday high of USD64.72, before scaling back its gain to close USD0.22 higher at USD63.27. Price actions over the coming sessions are critical given the black gold’s inability to decisively cross the said immediate resistance over the past two sessions. Based on the daily chart, should the immediate support of USD61.13 be breached to the downside, this could potentially mean the commodity’s rebound has reached an interim top. For now, maintain our positive trading bias.

As we have yet to see signs that the commodity is experiencing a price rejection, we maintain our advice for traders to stay in long positions. We initiated these at USD59.20, or the closing level of 6 Dec 2019. For riskmanagement purposes, a stop-loss can now be placed below USD61.13.

The immediate support is set at USD61.13, the low of 3 Jan. This is followed by USD59.85, which was the high of 6 Dec 2019. Conversely, immediate resistance is eyed at USD63.38, ie the high of 16 Sep 2019. This is followed by USD66.60, which was the high of 23 Apr 2019.

Source: RHB Securities Research - 7 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024