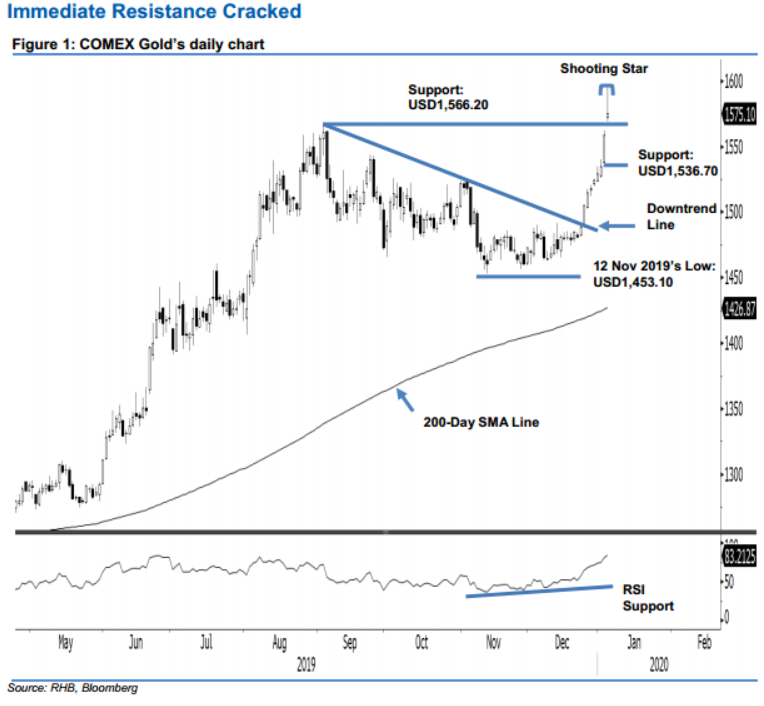

COMEX Gold - Immediate Resistance Cracked

rhboskres

Publish date: Tue, 07 Jan 2020, 11:30 AM

Maintain long positions while resetting the trailing-stop to break even. The COMEX Gold spiked in the latest session. At one point, it hit a high of USD1,595.70, before ending USD16.40 stronger at USD1,575.10. The positive closing placed the precious metal above the previous immediate resistance of USD1,566.20. Despite the appearance of the “Shooting Star” formation on the back of the overbought RSI reading, at this juncture, we are seeing the upside breach of the said previous immediate resistance as a good overriding positive observation. Hence, until there are negative price actions in the coming sessions to signal price exhaustion, we are keeping our positive trading bias.

As we have yet to see a price exhaustion signal, we continue to recommend traders stay in long positions. We initiated these at USD1,529.30, the closing level of 31 Dec 2019. For risk-management purposes, a stop-loss can now be placed at the breakeven level.

We revise the immediate support to USD1,566.20, the high of 4 Sep 2019. This is followed by USD1,536.70, the low of 3 Jan. Moving up, immediate resistance is now expected at USD1,600.00. This is followed by USD1,619.70, the high of 26 Feb 2013.

Source: RHB Securities Research - 7 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024