E-mini Dow Futures - Taking a Pause

rhboskres

Publish date: Wed, 08 Jan 2020, 06:23 PM

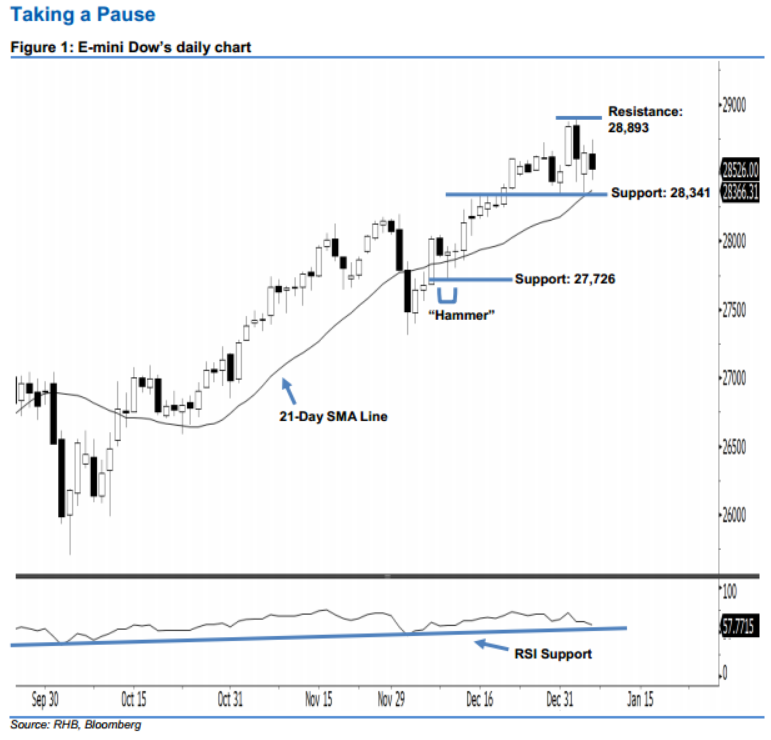

Maintain long positions. The E-mini Dow ended lower to form a black candle last night. It dropped 116 pts to close at 28,526 pts, after oscillating between a high of 28,739 pts and low of 28,446 pts. Despite its lower close last night, the index failed to erase the previous day’s gains, which indicates that the upside move has not diminished yet. Technically speaking, as the E-mini Dow continues to stay above the rising 21-day SMA line, this also implies that the rebound from 10 Dec 2019’s “Hammer” pattern remains valid. Overall, we stay bullish on the index’s outlook.

According to the daily chart, the immediate support level is now seen at 28,341 pts, set near the lows of 31 Dec 2019 and 6 Jan. The next support is maintained at 27,726 pts, determined from the low of 10 Dec 2019’s “Hammer” pattern. On the other hand, the near-term resistance level is anticipated at the 28,893-pt historical high. This is followed by the 29,000-pt psychological mark.

To re-cap, we initially recommended traders to initiate long positions above the 28,159-pt level on 17 Dec 2019. We continue to advise them to stay long for now, while setting a new trailing-stop below the 28,341-pt mark. This is in order to lock in part of the profits

Source: RHB Securities Research - 8 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024