E-mini Dow Futures - Bulls Regain Their Shine

rhboskres

Publish date: Fri, 10 Jan 2020, 05:21 PM

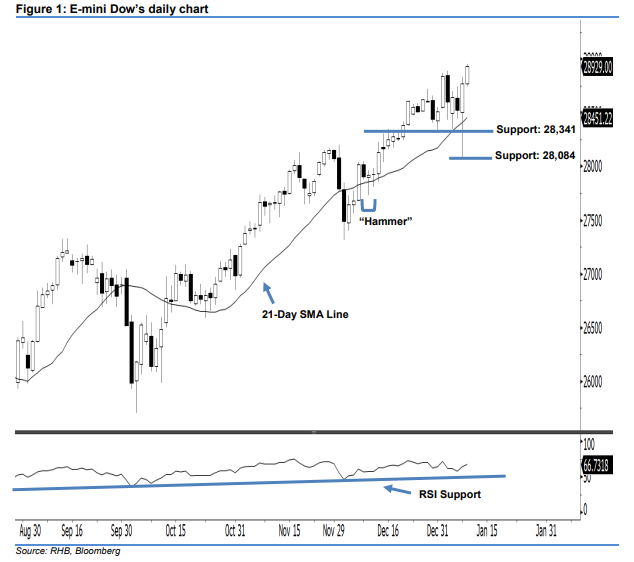

Market records new historical high; stay long. The E-mini Dow’s upside move has continued as expected, as a second consecutive white candle was formed last night. It gained 159 pts to close at 28,929 pts, off its low of 28,745 pts. From a technical perspective, yesterday’s candle has taken out the previously indicated 28,893-pt resistance – it also sent the index to its new record high. This indicates that the bullish trend is likely to persist. Overall, we believe the upside swing, which began from 10 Dec 2019’s “Hammer” pattern, may continue. Based on the daily chart, the immediate support level is seen at 28,341 pts – this was determined near the lows of 31 Dec 2019 and 6 Jan. The next support will likely be at 28,084 pts, ie the previous low of 8 Jan. On the other hand, we now eye the immediate resistance level at the 29,000-pt psychological mark. Meanwhile, the next resistance is anticipated at the 29,500-pt round figure. Hence, we advise traders to maintain long positions, in line with our initial recommendation to have long positions above the 28,159-pt level on 17 Dec 2019. A trailing-stop set below the 28,341-pt threshold is advisable to secure part of the gains.

Source: RHB Securities Research - 10 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024