FCPO - Correction Phase May Be Developing

rhboskres

Publish date: Wed, 15 Jan 2020, 05:19 PM

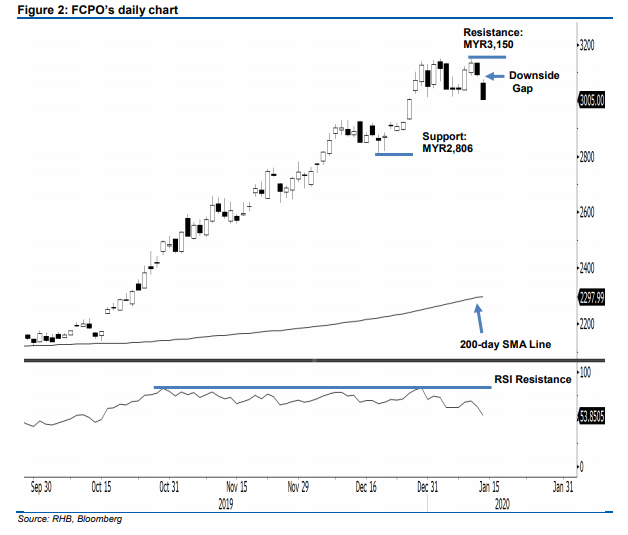

Correction signal emerges; initiate short positions. The FCPO kick-started yesterday’s session with a “Downside Gap”. At the close, it marginally crossed the previous immediate support of MYR3,011. The commodity settled MYR87 lower at MYR3,005 – the low and high were posted at MYR3,004 and MYR3,075. The breakdown from the said previous immediate support, after two failed attempts to cross the MYR3,150 immediate resistance recently, indicates that the commodity has likely entered into a correction phase. The expected correction phase could be lengthy, as this is meant to correct its previous multi-month sharp upward move. As such, we switch our trading bias to negative.

Our previous long positions, initiated at MYR2,175 – the closing level of 9 Oct – were closed out in the latest session. On the expectation that a correction phase has set in, we initiate short positions at the latest closing. To manage risks, a stop-loss can now be placed above MYR3,150.

We revised the immediate support to MYR2,806, the low of 18 Dec. This is followed by MYR2,700. Moving up, the immediate resistance level is now at MYR3,150, the high of 9 Jan. This is followed by MYR3,202, the high of 19 Dec 2016.

Source: RHB Securities Research - 15 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024