WTI Crude Futures - Retracement Is Extending

rhboskres

Publish date: Tue, 28 Jan 2020, 10:10 AM

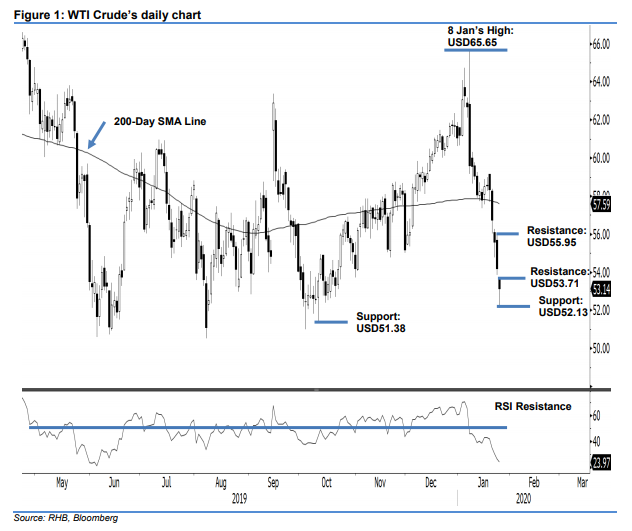

Maintain short positions as the slide is escalating. The WTI Crude extended its sliding mode in the latest trade – this was after it recently breached below the 200-day SMA line. The session’s low and high were recorded at USD52.13 and USD53.71, before closing USD1.05 weaker at USD53.14. Despite the commodity managing to recoup around half of its losses on an intraday basis, this is still insufficient to indicate a potential interim low – despite the oversold RSI reading. Premised on this, we keep to our negative trading bias.

As the bears are having a clear dominance, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can now be placed above the USD55.95 mark.

We revise the immediate support to USD52.13, the latest low, followed by USD51.38, the low of 10 Oct 2019. Meanwhile, the immediate resistance is now eyed at USD53.71, the latest high. This is followed by USD55.95, the high of 24 Jan.

Source: RHB Securities Research - 28 Jan 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024