FKLI - Still Sliding Downwards

rhboskres

Publish date: Tue, 04 Feb 2020, 11:26 AM

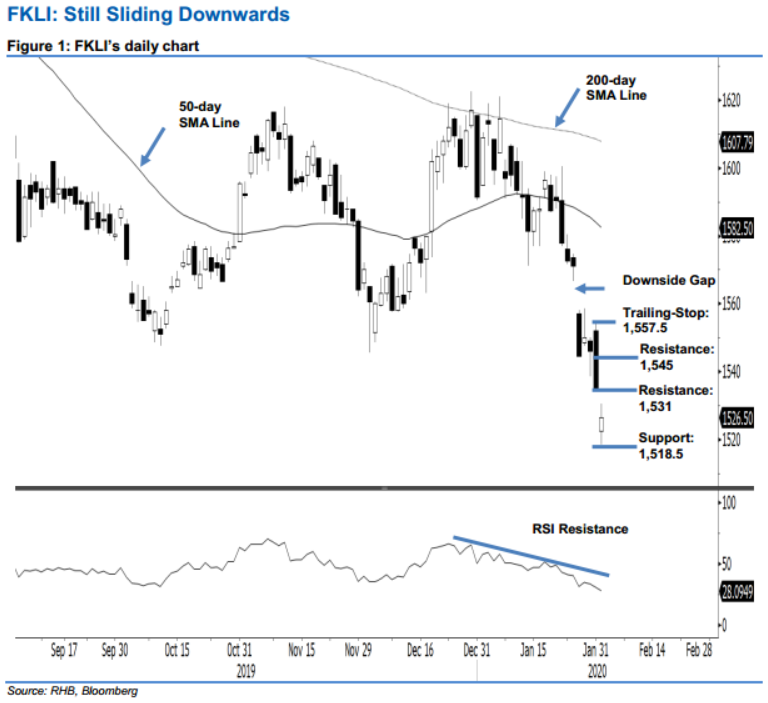

Bearish bias is extending; maintain short positions. The FKLI closed 7 pts weaker yesterday, at 1,526,5 pts, after it recouped most of its intraday losses. The low was recorded at 1,518.5 pts. The weak performance continues to suggest that the index’s weak bias is still firmly in place. This is after it completed its multi-month countertrend rebound between Oct 2019 and early January, when it failed to cross the 200-day SMA line. While the RSI reading points to an oversold condition, until price reversal signals emerge, we make no change to our negative trading bias.

With the bears are still in firm control, traders are advised to remain in short positions. We initiated these at 1,544.5 pts, the closing level of 28 Jan. To manage risks, a stop-loss can be placed above 1,557.5 pts.

Immediate support is now pegged at 1,518.5 pts, the latest session’s low. This is followed by the 1,500-pt mark. Conversely, the immediate resistance is now set at 1,531, the low of 31 Jan. This is followed by 1,545 pts, near the middle of the 31 Jan’s candle.

Source: RHB Securities Research - 4 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024