FCPO - Minor Pause Taking Place

rhboskres

Publish date: Mon, 10 Feb 2020, 09:25 AM

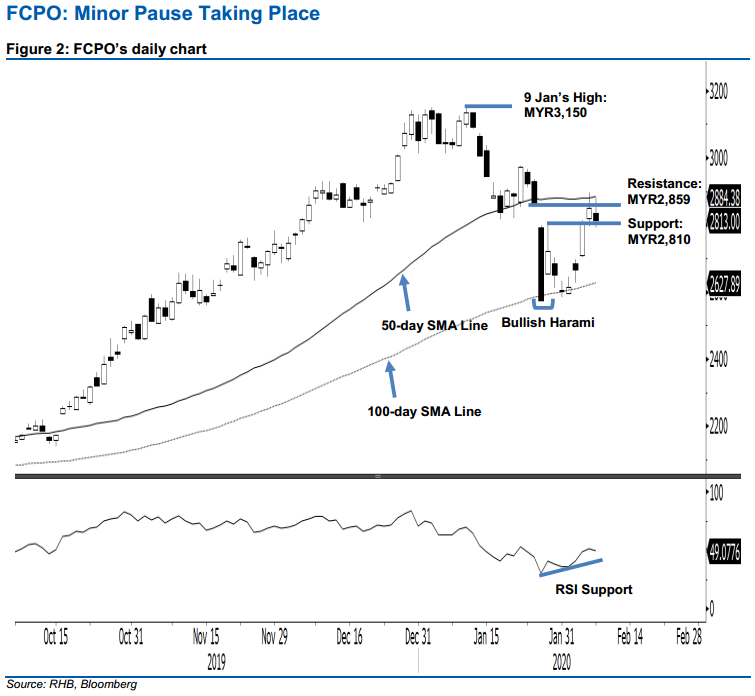

Maintain long positions as upward move is still valid. Last Friday, the FCPO tested the immediate support of MYR2,810 with a low of MYR2,791, before closing MYR37 lower at MYR2,813. The commodity is showing signs of developing a minor pause – after it briefly tested the immediate resistance of MYR2,859 and the 50-day SMA line in the prior session. We believe its multi-week correction phase has come to an end, with the testing of the 100-day SMA line, supported by the emergence of the “Bullish Harami” formation on 29 Jan. We maintain our positive trading bias.

As we are not seeing the latest weak performance as a sign of a negative price reversal, we maintain our long positions. We initiated these at MYR2,804, the closing level of 5 Feb. To manage risks, a stop-loss can be placed below MYR2,704.

The immediate support remains at MYR2,810, the high of 29 Jan. This is followed by MYR2,752, derived from the 5 Feb candle. Conversely, the immediate resistance is set at MYR2,859, the low of 24 Jan. This is followed by the MYR2,900 round figure.

Source: RHB Securities Research - 10 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024