WTI Crude Futures - Bearish Tone Still Not Ending

rhboskres

Publish date: Tue, 11 Feb 2020, 09:38 AM

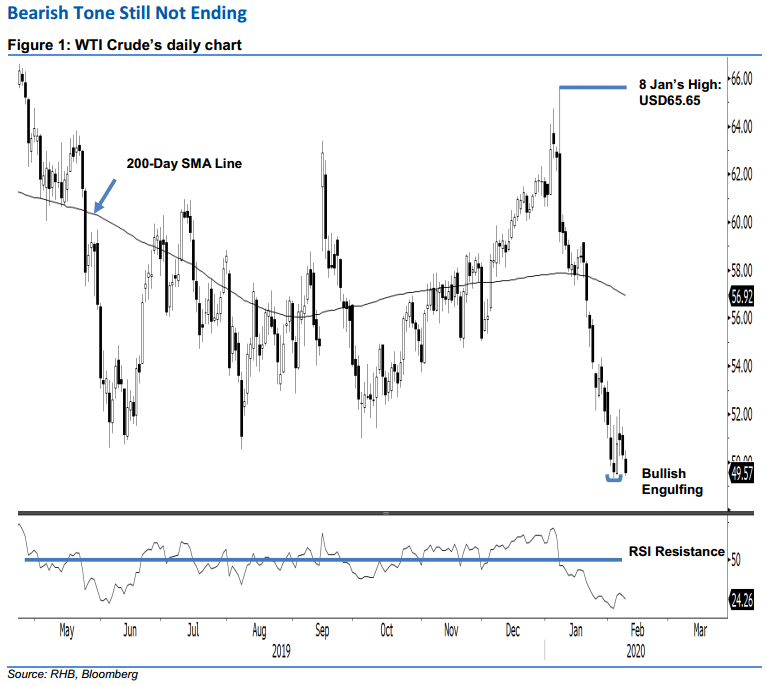

Maintain short positions, as the bears are reasserting control. The WTI Crude fell USD0.75 to close at USD49.57 during the latest session. This breached the previous USD50.24 immediate support. While the commodity has been showing signs of staging a rebound after the appearance of the “Bullish Engulfing” formation on 8 Feb – on an extremely oversold RSI reading – price actions suggest such a rebound is still relatively mild and does not suggest a trend reversal. Premised on this, we are keeping our negative trading bias.

On the observation that the bears are still in firm control over the price trend, we advise traders to stay in short positions. These were initiated at USD59.61, or the closing level of 8 Jan. To manage the risk, a stop-loss can now be placed above the USD52.29 level.

The immediate support is revised to USD49.31, ie the low of 5 Feb’s “Bullish Engulfing” pattern. This is followed by USD48.11, or the low of 7 Jan 2019. Moving up, we are now eying the USD50.50 immediate resistance, which was derived from 7 Feb’s candle. This is followed by USD51.50, ie derived from 7 Feb’s candle.

Source: RHB Securities Research - 11 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024