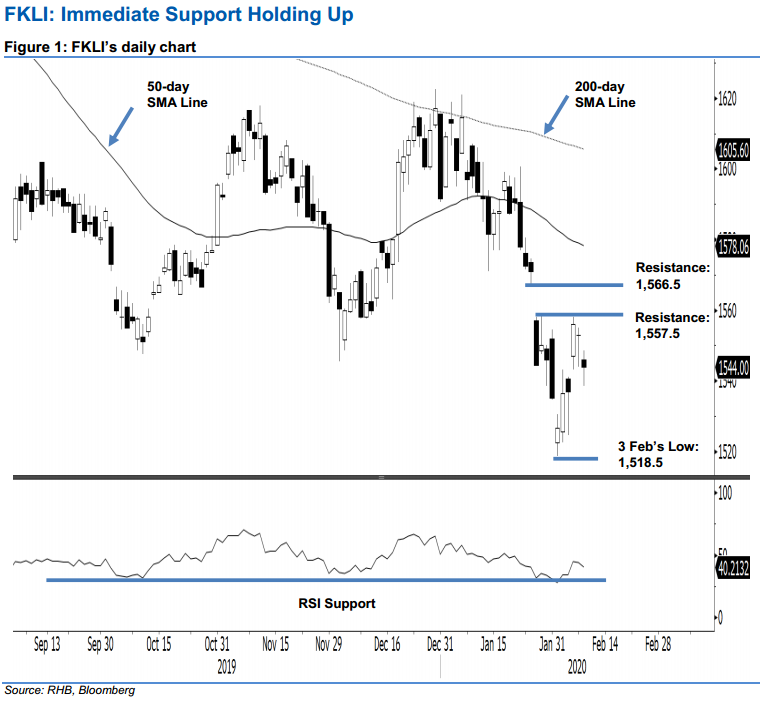

FKLI - Immediate Support Holding Up

rhboskres

Publish date: Tue, 11 Feb 2020, 09:48 AM

Maintain long positions as the immediate support is still holding up. The FKLI formed a black candle to settle 9 pts weaker at 1,544 pts. Trading ranged between 1,538.5 pts and 1,5485 pts. The index has been undergoing consolidation after it experienced a relatively sharp rebound and tested the immediate resistance of 1,557.5 pts since two sessions ago. We believe as long as the said immediate support is not breached at the closing, the countertrend rebound may still be able to extend further. Hence, we are keeping our positive trading bias.

As the bulls are still able to hold the index above the said immediate support for the second consecutive session, we recommend that traders remain in long positions. We initiated these at 1,556 pts, the closing level of 6 Feb. To manage risks, a stop-loss can be placed below 1,543 pts.

The immediate support is pegged at 1,543 pts, the high of 4 Feb. This is followed by 1,531 pts – derived from 5 Feb’s candle. Conversely, the immediate resistance is pegged at 1,557.5 pts – the high of 31 Jan. This is followed by 1,566.5 pts, the low of 24 Jan.

Source: RHB Securities Research - 11 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024