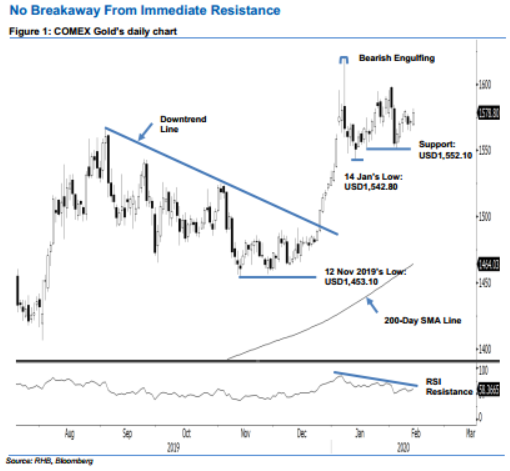

COMEX Gold - No Breakaway From Immediate Resistance

rhboskres

Publish date: Fri, 14 Feb 2020, 05:12 PM

No signal for resumption of rebound; maintain short positions. The COMEX Gold ended the latest session on a positive note. At one point, the precious metal tested the immediate resistance of USD1,580.50 with an intraday high of USD1,581.70. This was before it settled USD7.20 higher at USD1,578.80. As mentioned in our recent reports, provided the said resistance point is not breached, chances are still high that the commodity’s correction phase that started from the failed attempt to cross above the USD1,600 mark would remain in place. Maintain our negative trading bias.

As the thesis for the correction has not been invalidated yet, we maintain our short positions recommendation. We initiated these at USD1,555.50, or the closing level of 4 Feb. For risk-management purposes, a stop-loss can be placed above the USD1,580.50 level.

Immediate support is maintained at USD1,563.50, which was the low of 7 Feb. This is followed by USD1,552.10, ie the low of 21 Jan. Moving up, the immediate resistance is set at USD1,580.50, or the high of 10 Feb. This is followed by USD1,600 round figure.

Source: RHB Securities Research - 14 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024