E-mini Dow Futures - Taking a Breather

rhboskres

Publish date: Mon, 17 Feb 2020, 10:53 AM

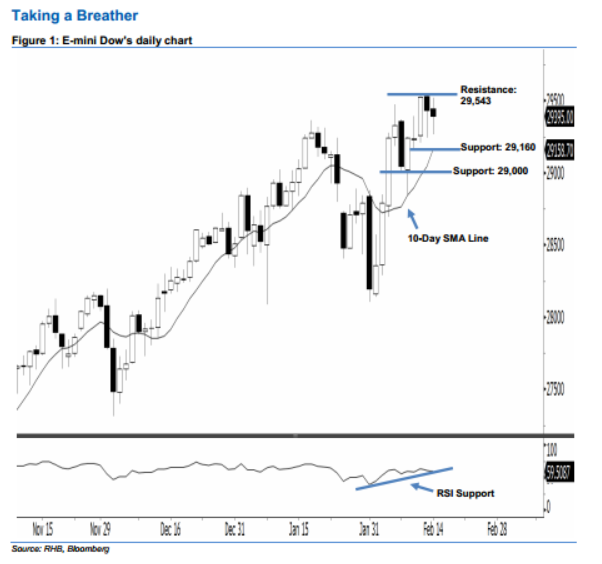

Stay long while setting a trailing-stop below the 29,160-pt level. The E-mini Dow formed a black candle last Friday. It declined 37 pts to settle at 29,395 pts. Yet, the appearance of 13-14 Feb’s black candles can be viewed as a result of profit-taking activities following the recent gains. Technically speaking, in view that the 10-day SMA line is likely to turn higher, the bullish sentiment has therefore been enhanced. Overall, we expect the market to rise further if the immediate 29,543-pt resistance is taken out decisively in the coming sessions.

Presently, the immediate support level is anticipated at 29,160 pts, ie near the rising 10-day SMA line. Meanwhile, the next support is seen at the 29,000-pt round figure, situated near the midpoint of 5 Feb’s long white candle as well. Towards the upside, we now anticipate the immediate resistance level at the 29,543-pt historical high. If a decisive breakout arises, the next resistance is set at the 30,000-pt psychological mark.

Therefore, we advise traders to stay long, given that we initially recommended initiating long above the 28,600-pt level on 5 Feb. In the meantime, a trailing-stop set below the 29,160-pt threshold is preferable in order to lock in a larger part of the profits.

Source: RHB Securities Research - 17 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024