WTI Crude Futures - Testing the Immediate Resistance

rhboskres

Publish date: Fri, 21 Feb 2020, 05:52 PM

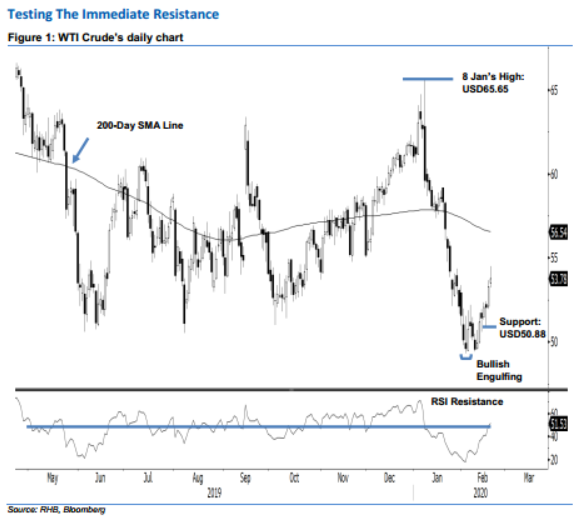

Maintain long positions to tag on the rebound. The WTI Crude settled the latest session USD0.49 higher at USD53.78. At one point, it tested the immediate resistance of USD54.37, with a high of USD54.50. We believe the 5 Feb “Bullish Engulfing” formation has marked the end of the commodity’s retracement leg from the high of USD65.65 recorded on 8 Jan. With that, the commodity is likely in the process of staging a stronger rebound, if not resuming its upward move that started from Dec 2018. At this juncture, we believe this bias would stay provided the USD50.88 support is not breached to the downside. Maintain our positive trading bias.

As the bias is for the rebound to extend further, we recommended traders to stay in long positions. These were initiated at USD53.29, the closing level of 19 Feb. To manage the risk, a stop-loss can be placed below USD50.88.

Immediate support is expected at USD52.30, derived from 19 Feb’s candle. This is followed by USD50.88, the low of 18 Feb. Conversely, immediate resistance is set at USD54.37, a price point from 29 Jan’s candle. This is followed by USD55.60, derived from 24 Jan’s candle.

Source: RHB Securities Research - 21 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024