WTI Crude Futures: Stop-Loss Level Holding Up

rhboskres

Publish date: Tue, 25 Feb 2020, 11:21 AM

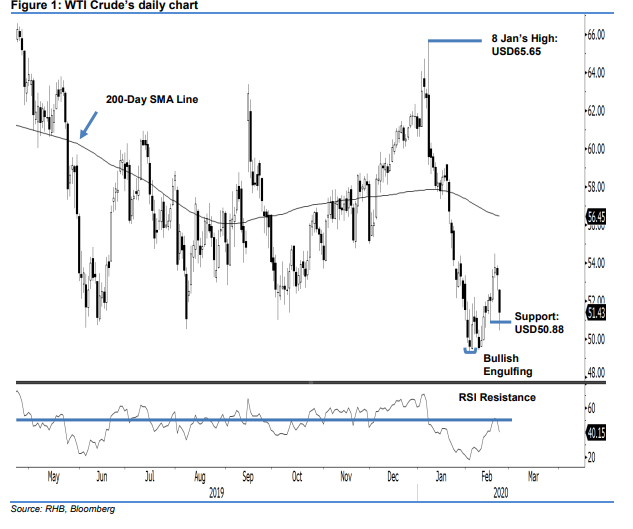

Stop-loss briefly tested; maintain long positions. The WTI Crude formed a black candle to soften USD1.95 at USD51.43. The session also witnessed the USD50.88 support level briefly tested. As mentioned in our recent reports, we are currently expecting the commodity to stage a stronger rebound phase, if not resume its upward move, which started from Dec 2018. This bias should stay as long as the said support level is not breached at the closing. Maintain our positive trading bias.

As the bears were not able to invalidate our positive bias in the latest session, we recommend traders to stay in long positions. These were initiated at USD53.29, or the closing level of 19 Feb. To manage the risk, a stop-loss can be placed below the USD50.88 mark.

We revised the immediate support to USD50.88, ie the low of 18 Feb. This is followed by USD50.45, the latest session’s low. Towards the upside, the immediate resistance is now set at USD52.30, derived from the latest candle. This is followed by USD53.60, a price point from 21 Feb’s candle.

Source: RHB Securities Research - 25 Feb 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024