WTI Crude Futures - Capped by An Immediate Resistance

rhboskres

Publish date: Thu, 05 Mar 2020, 05:32 PM

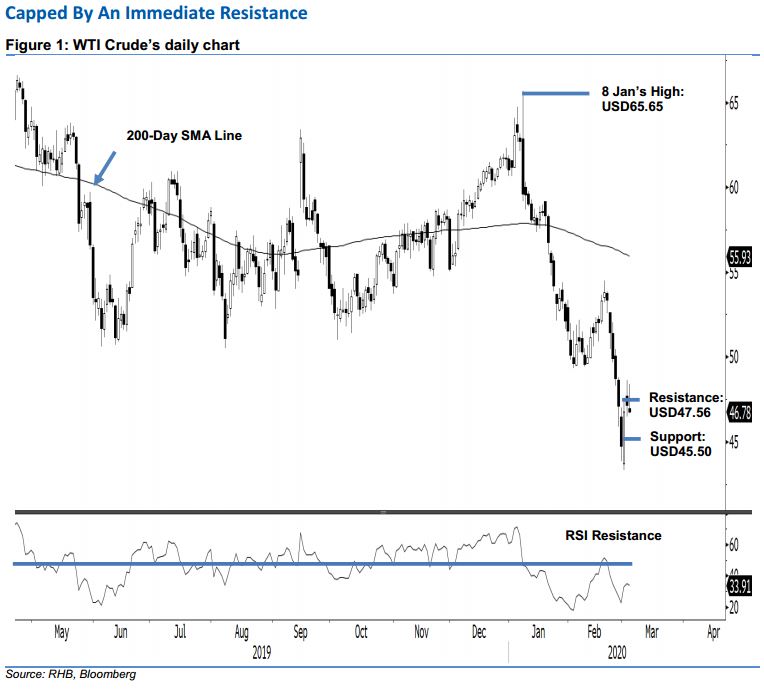

Maintain short positions, as the commodity is still unable to settle above the immediate resistance. The WTI Crude continued to fail in settling above the USD47.56 immediate resistance, as it failed to hold on to the earlier session’s positive tone. After peaking at USD48.41, the black gold retraced to settle at USD46.78 – indicating a USD0.40 decline. After a sharp spike on 2 Mar, the WTI Crude has still not been able to signal a firm positive price continuation, and has remained capped by said immediate resistance at the close. Hence, we are keeping our negative trading bias.

With no clear positive price continuation signals, we recommend traders stay in short positions. We initiated these at USD49.90, or the closing level of 25 Feb. To manage the risk, a stop-loss can be placed above the USD47.56 mark.

The immediate support is kept at USD46.40, followed by USD45.50 – both are derived from 2 Mar’s candle. Moving up, resistance points are pegged at USD47.56 – the high of 2 Mar – and USD48.78, ie the price point of 27 Feb.

Source: RHB Securities Research - 5 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024