FKLI - Meltdown In Session

rhboskres

Publish date: Tue, 10 Mar 2020, 10:16 AM

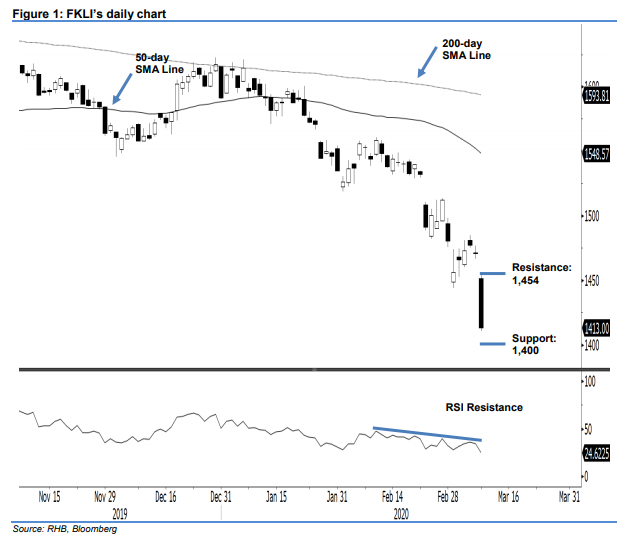

Maintain short positions as the retracement is extending. The FKLI formed a “Downside Gap” at the close yesterday, and settled 58 pts lower at 1,413 pts. The session’s high was posted at 1,454 pts. The negative performance confirmed our bias that the index’s retracement has resumed after the rebound chalked in prior sessions. While the RSI is flashing out an oversold reading again, without a price reversal signal, the downtrend should remain in place. As such, we maintain our negative trading bias.

As the latest price action continues to signal that the bears are in firm control of the market, we recommend traders to remain in short positions. We initiated these at 1,548.5 pts, the closing level of 12 Feb. To manage risks, a stop-loss can be placed above 1,454 pts

The immediate support is revised to the 1,400-pt round figure, followed by 1,380 pts – the low of 10 Oct 2011. Towards the upside, the immediate resistance is now pegged at 1,430 pts, followed by 1,454 pts – both are derived from the latest candle.

Source: RHB Securities Research - 10 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024