Hang Seng Index Futures: Short Positions Now Activated

rhboskres

Publish date: Tue, 10 Mar 2020, 10:20 AM

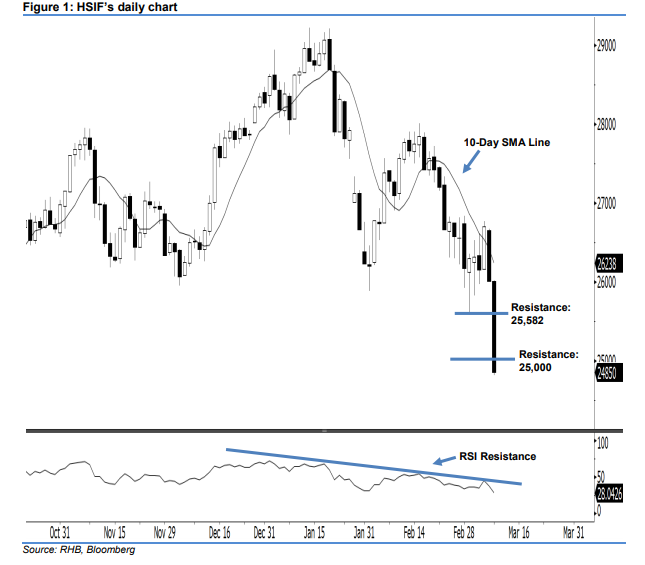

Initiate short positions below the 25,000-pt level. The HSIF formed a “Long Black Day” candle yesterday, indicating a strong selling momentum. It tumbled 1,160 pts to close at 24,850 pts. Technically speaking, the index has posted a second consecutive black candle and hit its 6-month low, implying that the sentiment has turned bearish. This can be viewed as a continuation of the sellers extending the downside swing from 20 Jan’s long black candle. Yesterday’s closing also triggered our stop-loss, which we had previously recommended at the 25,971-pt level.

According to the daily chart, the immediate resistance level is seen at the 25,000-pt round figure. The next resistance is anticipated at 25,582 pts, ie the low of 2 Mar. To the downside, we are eyeing the immediate support level at 24,457 pts, which was the previous low of 29 Oct 2018. If a breakdown arises, the next support is seen at the 24,000-pt psychological spot.

Consequently, we advise traders to initiate short positions below the 25,000-pt level. A stop-loss can be set above the 25,582-pt threshold to limit the risk per trade.

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024