COMEX Gold - Tightening Up Trailing-Stop

rhboskres

Publish date: Tue, 10 Mar 2020, 10:21 AM

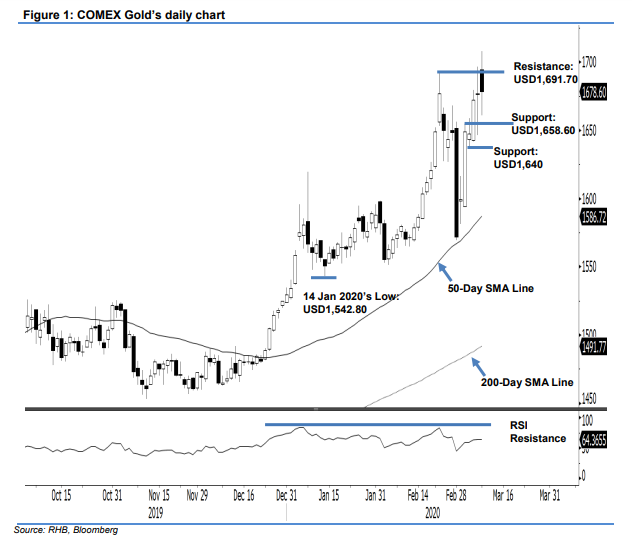

Maintain long positions. The COMEX Gold added USD2.50 to close at USD1,678.60 in the latest session, after hitting a high of USD1,707.80. However, we observe that despite testing the immediate resistance of USD1,691.70 over the past two sessions, the commodity was still unable to settle above this level. This implies the risk for a possible price rejection has increased. Towards the downside, based on the daily chart, a breach of the USD1,640 support level would likely confirm a price rejection from the said level.

Until this happens, we are keeping our positive trading bias. Until the positive bias is invalidated, we recommend traders stay in long positions. These were initiated at USD1,648.90, or the closing level of 3 Mar. For risk-management purposes, a stop-loss can be placed below USD1,640.00.

The immediate support is still set at USD1,658.60, which was derived from 4 Mar’s candle. This is followed by USD1,640.00, or 5 Mar’s price point. Moving up, the immediate resistance is maintained at USD1,691.70, 24 Feb’s high, followed by the USD1,700 round figure

Source: RHB Securities Research - 10 Mar 2020

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024