WTI Crude Futures - Tagging the Rebound

rhboskres

Publish date: Thu, 30 Apr 2020, 05:01 PM

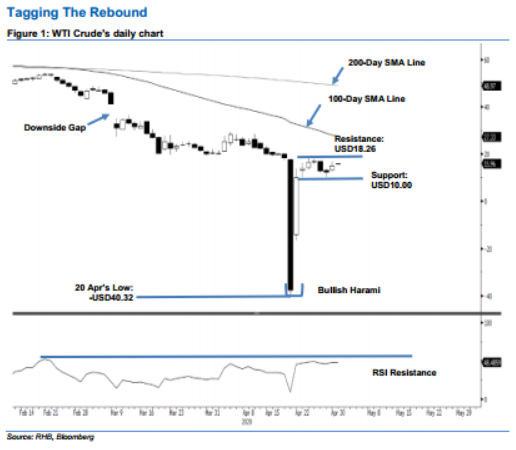

Initiate long positions. The WTI Crude continued to trade in a volatile fashion, ranging between USD12.67 and USD16.78 before closing at USD15.06 – above the previous immediate resistance of USD14.50. This implies that the commodity’s subsequent rebound from 21 Apr’s “Bullish Harami” formation is gaining firmer traction and could be extended further. Towards the upside – based on the recent sessions’ price actions – there is a good chance for the WTI Crude to test the USD18.26 resistance point. Recall that this rebound set in after the commodity experienced a historic washout on 20 Apr and we saw the RSI reading reach oversold territory. We switch our trading bias to positive.

Our previous short positions – initiated at USD23.63, or the closing level of 7 Apr – were closed out above the USD14.50 level during the latest session. We also initiate long positions at the latest closing threshold. To manage the risk, a stop-loss can be placed below the USD13.00 level.

The immediate support is revised to USD13.00, or the price point of the latest session. This is followed by the USD10.00 mark. Towards the upside, the immediate resistance is now pegged at the USD17.00 threshold – this is followed by USD18.26, ie the high of 23 Apr.

Source: RHB Securities Research - 30 Apr 2020