Hang Seng Index Futures - Kicks Out From the 50-Day SMA Line

rhboskres

Publish date: Mon, 01 Jun 2020, 10:40 AM

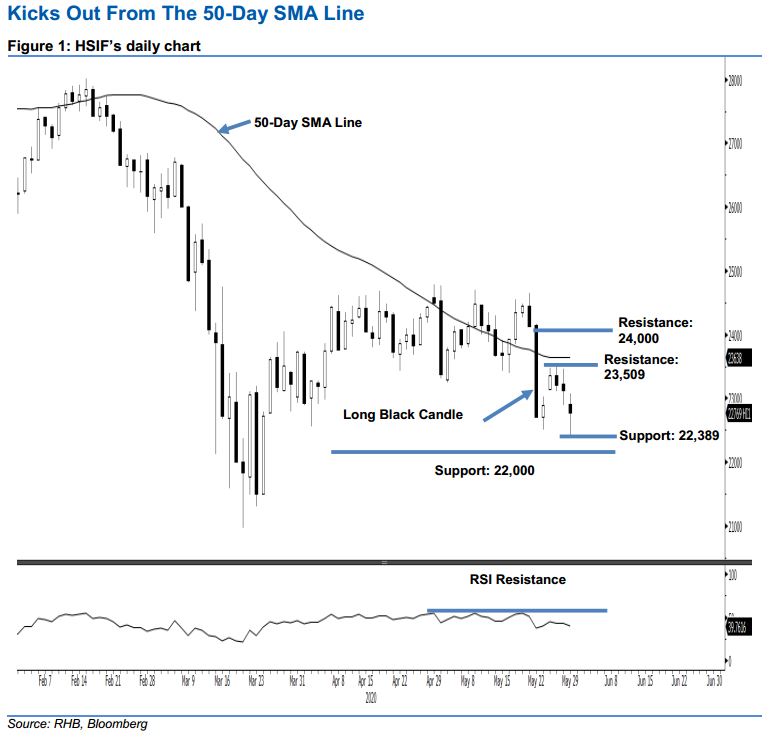

Short positions are favoured. Despite managing to reverse a good portion of its earlier session’s losses, the HSIF ended the latest session 360 pts weaker at 22,769 pts – the low was posted at the 22,389-pt level. The negative session can be seen as a follow-up from the index piercing through the 50-day SMA line with a “Long Black Candle” on 22 May, where subsequent attempts to regain this line have failed. Towards the upside, we believe that, as long as the HSIF remains capped by the 24,000-pt resistance, the risk for further retracement should remain high.

In the absence of a price reversal signal to mark an end to the retracement, we recommend traders stay in short positions. These were initiated at 23,355 pts, or the closing level of 26 May. For risk-management purposes, a stoploss can be placed above 24,000 pts.

The immediate support is pegged at 22,389 pts, which was the latest session’s low. This is followed by 22,000-pt round figure. Meanwhile, the immediate resistance is eyed at 23,509 pts, or the high of 27 May. This is followed by 24,000 pts – a round figure that is slightly above the 50-day SMA line.

Source: RHB Securities Research - 1 Jun 2020