Hang Seng Index Futures - Back Above the 50-Day SMA Line

rhboskres

Publish date: Wed, 03 Jun 2020, 10:17 AM

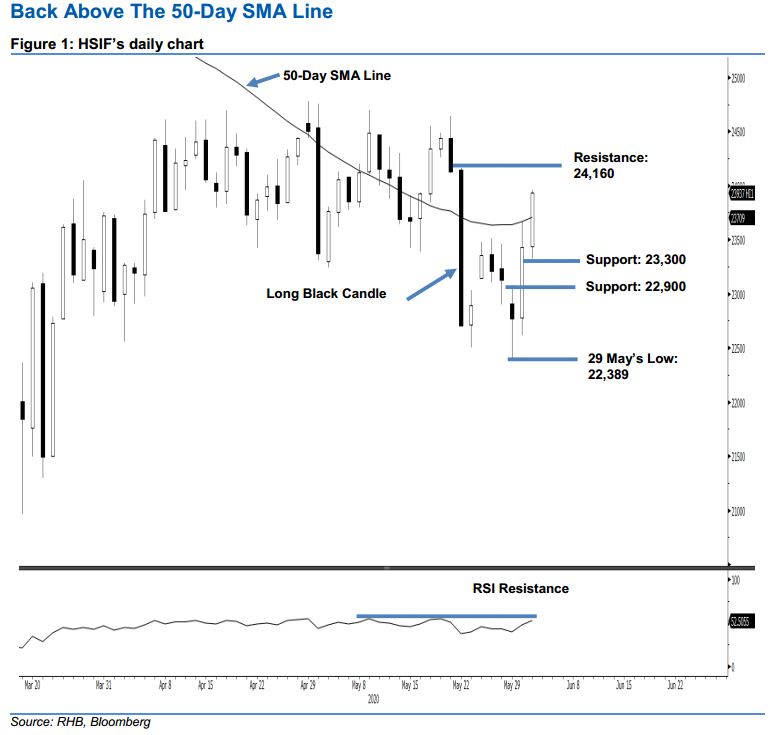

Maintain short positions, as the index is still capped by the 24,000-pt stop-loss. The HSIF extended its strong rebound for a second consecutive session after reaching a 22,389-pt low on 29 May. At the closing, the index settled 512 pts stronger at 23,937 pts. The closing level also places the HSIF slightly back above the 50-day SMA line. At this juncture, in order for the index to signal that its recent correction phase has reached an end, the 24,000- pt immediate resistance needs to be crossed at the close of the coming sessions. Pending this, we are keeping our negative trading bias.

We are recommending traders stay in short positions. These were initiated at 23,355 pts, ie the closing level of 26 May. For risk-management purposes, a stop-loss can be placed above the 24,000-pt threshold.

The immediate support is revised to 23,300 pts, which is near the latest low. This is followed by 22,900 pts, ie price point of 1 June. Meanwhile, the immediate resistance is now eyed at the 24,000-pt level, a round figure slightly above the 50-day SMA line. This is followed by 24,160 pts, or the high of 22 May.

Source: RHB Securities Research - 3 Jun 2020